As the nation celebrated its 242nd birthday last week, investors found opportunities to buy gold and silver.[1] Prices for the yellow metal have remained hemmed in by rising interest rates and a strong dollar. However, as the trade war escalates from threats by politicians to effective tariffs, it will only be a matter of time before the full economic impact is felt. Given the country’s already brewing economic problems—rising inflation and a predicted recession—it’s never been a better time to hedge against future financial uncertainly with precious metals.

Geo-economic risk, a strong dollar, and rising interest rates are moving gold prices this week, but what other forces have historically driven the market? Read “How These 10 Factors Regularly Influence Gold Prices” to find out.

Gold Price Movement Indicators:

Monday, July 2, 2018

Stronger Dollar

Better-than-expected data from the U.S. manufacturing sector and falling foreign currencies boosted the dollar on Monday. Accounting for about 12 percent of the U.S. economy, manufacturing jumped to a reading of 60.2 in June from 58.7 in May, reported the Institute for Supply Management (ISM). The data points to an expanding manufacturing sector and, more generally, economy.[2] Amid fears of a U.S.-China trade war, Asian currencies, specifically the Chinese yuan, Indian rupee, and Japanese yen, weakened.[3]

Analysts pointed to the strong dollar for gold’s recent performance but remained optimistic about the precious metal. ‘The excuse for gold being down so much starts with the dollar… [but I] would not be surprised to see a big gold rally in the near future,’ said Altavest managing partner Micheal Armbruster. He went on to predict a possible $50 an ounce gain in gold prices.

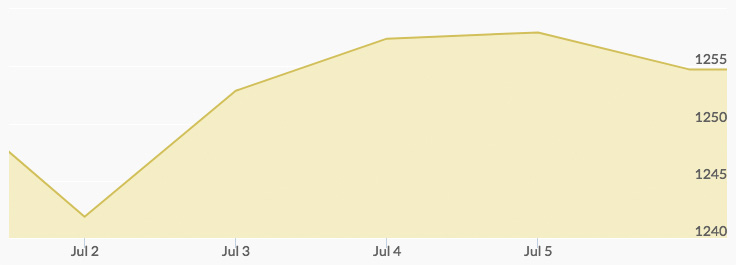

A stronger dollar makes gold more expensive for foreign investors, and a growing economy usually stokes investors’ risk appetite for equities. The price of gold climbed from the weekly low of $1,238.60 at 10 pm to the high of $1,250.40 at midnight.

Tuesday, July 3, 2018

Weaker Dollar

The resolution of immigration issues in Germany pushed the euro up .4362 percent, erasing the dollar’s Monday gains; the greenback fell .46 percent, making gold prices more appealing for foreign buyers. Treasury yields slipped on Tuesday as prices for government paper rose, also adding to the luster of rival safe haven gold. ‘First the dollar flipped, and it looks like interest rate dropped for the 10-year,’ indicated Bart Melek, head of commodity strategy at TD Securities.[4]

Prices for the yellow metal climbed considerably from their low of $1,238.30 at 1 am to their high of $1,259.10 at 10 pm.

Wednesday, July 4, 2018

Weaker Dollar

The dollar descended further on the Fourth of July holiday. The dollar index, a measurement of the dollar against a basket of six major currencies, fell .3 percent. International investors capitalized on the currency’s fall, with gold purchases pushing the precious metal up over $20 from the Tuesday low to $1,261.10—the high for the week.

‘Modest declines in the U.S. dollar index and equity markets is helping gold,’ asserted National Australia Bank economist John Sharma. Sentiment was stronger in favor of the yellow metal in the Land Down Under, with a Sidney-based trader predicting gold’s reaction to the trade war to shift and for the metal to rally.

Thursday, July 5, 2018

Rising Interest Rates

The Federal Open Market Committee (FOMC) approved another quarter-point increase in the benchmark overnight borrowing rate, moving it to a range of 1.75 percent to 2 percent. Rising interest rates can make interest-bearing assets more appealing to investors and weigh on gold prices. However, the price of gold remained relatively strong, buoyed by a softer dollar. The high of $1,257.40 was hit at 5 pm.[5]

Rate hikes usually support the dollar, but central bank concerns about the next recession, increasing inflation, and the trade war may have sent jitters through the markets.

Friday, July 6, 2018

Trade War

At 12:01 am EDT on Friday, a 25 percent tariff on 34 billion worth of Chinese goods took effect. China struck back with harsh words and equally steep tariffs. A spokesperson at China’s Ministry of Commerce asserted that the “U.S. had ‘launched the largest trade war in economic history.’” He went on to accuse the U.S. of ‘trade bullying’ and predict dire consequences for the global economy.

Economists echoed this sentiment on Friday. ‘This is hurting the economy but so far it’s manageable. If the war continues to escalate, it will do more damage and at some point it will undercut the good economy,’ said Moody’s Analytics economist Mark Zandi.

When that ‘damage’ hits, gold will ascend back to its traditional safe haven status. On Friday, there were still plenty of buying opportunities for investors though. The high of $1,256.10 at 3 am was followed by the low of $1,253.50 at noon.

Where is the price of gold now? Check our Gold Spot Price Chart for live and historic prices.