Last week, gold continued to be caught between the dueling market forces of the dollar and the trade war. Backed by the Fed and rising interest rates, the dollar triumphed. However, as the countries targeted with import tariffs struck back not only with retaliatory tariffs that could hurt the U.S. economy but also currency devaluation—specifically the yuan—that could eventually dethrone the dollar as the global reserve currency, the trade war is starting to appear as the mightier opponent.[1] Add rising U.S. inflation to the picture, and the outlook for the spot price of gold gets even brighter.[2]

Read “How These 10 Factors Regularly Influence Gold Prices” to learn more about the forces the have historically moved gold prices.

Gold Price Movement Indicators:

Monday, June 25, 2018

Strong Dollar

A stronger dollar makes gold more expensive for foreign investors and can put pressure on prices. Although the ICE U.S. Dollar Index was up 2.4 percent for the year, it was down 0.2 percent at 94.33 on Monday, suggesting the greenback may be feeling the weight of geo-economic pressures. Deteriorating U.S.-China relations could bring it down further. ‘The dollar from a longer-term perspective to me looks very fragile,” said asset manager Carlos Hardenberg. With its traditionally inverse relationship to gold, a dollar decline could mean higher prices for the yellow metal.

Alternative Safe Haven Purchases

The trade war has sent investors into risk-off mode, but they’ve been buying U.S. Treasuries instead of gold. However, financial experts say gold stands to benefit from the trade war eventually. ‘Today on a relative basis, gold is performing better than commodities and equities,’ asserted Jens Pedersen, an analyst at Danske Bank.

Stock Market Decline

Investor risk aversion was evident in the performance of equities. Across the board, U.S. stocks closed severely lower on Monday, which saw major indexes record their biggest one-day decline in weeks. The Dow lost 328.09 points—its greatest one-day fall since May 29 and lowest close since May 4. It also closed below its 200-day moving average for the first time since June 2016. Many financial experts predict a major stock market correction or even crash is imminent and are advising investors that a diversified portfolio is the best way to protect their wealth.[3]

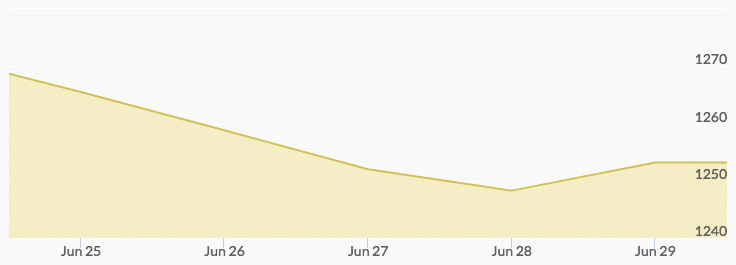

Gold’s low of $1,264.60 at 2 am was followed by the high for the week of $1,269.40 at 5 am.

Tuesday, June 26, 2018

Dovish Central Bank

Even central banks are concerned about the economic implications of the trade war. On Tuesday, it was reported that the Bank of International Settlements (BIS), the umbrella group for 60 central banks, expressed concern that the rise of protectionist trade policy could interfere with global economic growth and financial stability, not to mention hurt the currency markets.[4]

Fed bank presidents individually issued warnings last week, as well. Raphael Bostic, the president of the Atlanta branch, indicated that the intensifying trade tensions are jeopardizing the U.S. economy and may be grounds to rule out a fourth interest rate hike this year.

Citing the likely short-term boost the recent tax cuts will have on the economy, as well as a tightening labor market for minorities, St. Louis Fed president James Bullard argued the Fed should stop raising rates.

The Fed’s recent interest rate hike has supported the stronger dollar and steered investors toward interest-bearing assets like stocks. A more dovish policy could prove a headwind to the greenback and benefit gold.

With a high of $1,263.80 at midnight and a low of $1,253.80 at 11 pm, the news had yet to affect the gold markets.

Wednesday, June 27, 2018

Bitcoin Crash

Investors have been flocking to safe havens, but Bitcoin failed to make the cut this year. U.S. Treasuries could be next to lose favor. Despite news headlines about the strength of the dollar, the currency declined by 5 percent over the last eighteen months. Investors hedging against a falling dollar with Bitcoin may have been the reason behind the cryptocurrency’s strong performance last year. However, a slew of scandals, security breaches, and new regulations caused Bitcoin to plummet 70 percent from its December high and be compared to the “Nasdaq Composite Index’s 78 percent peak-to-trough plunge after the U.S. dot-com bubble burst.

Meanwhile, emerging markets have been unloading U.S. treasuries and buying gold big time. Just last April, Russia sold half of its Treasury holdings. The country has increased its official gold stockpiles annually since 2006, purchasing 600,000 ounces last year.

By Wednesday, gold was still battling it out with rival safe havens: the low of $1,251.30 was hit at 4 pm and the high of $1,258.90 at 8 am.

Thursday, June 28, 2018

Devalued Yuan

Thursday brought another explanation for the pullback in the price of gold: a weaker yuan. Over the past three months, China has devalued its currency by 6 percent. The move, which proves China has more than retaliatory tariffs in its arsenal to fight a trade war with, could keep Chinese goods cheap to negate the impact of import tariffs.

However, Chinese currency devaluation could have much more insidious consequences for the U.S. Last time the country devalued the yuan by 3 percent in 2015, the S&P dropped by 11 percent. And, as we saw on Monday, stocks are already suffering as a result of the trade war. Gold is correlated to the yuan, which makes it cheaper for gold-hoarding China. The nation has been buying and producing more of the yellow metal and could one day effectively back the yuan with gold. This latest move could bring China closer to its stated goal to end the dollar’s run as the global reserve currency.

Gold prices reflected the short-term effect of a weaker yuan, reaching the low of $1,246.60 at 3 pm and the high of $1,252.50 at 2 am and 7 am.

Friday, June 29, 2018

Inflation

News headlines on Friday added further fuel to the building gold rally. MarketWatch reported that core inflation reached the Fed’s target of 2 percent for the first time in six years. This is faster than the Fed predicted, and economists are saying inflation’s ‘momentum is likely still up.’

When it hits, investors who thought U.S. treasuries would save them will be sorry. History shows that gold is the best hedge against this economic blight.

Despite the news, gold stayed on its trajectory of late, with the low of $1,249.60 hit at 4 am and the high of 1,255.30 at 1 pm.

Need today’s spot gold price? Visit our Gold Spot Price Chart for historic and live gold prices.