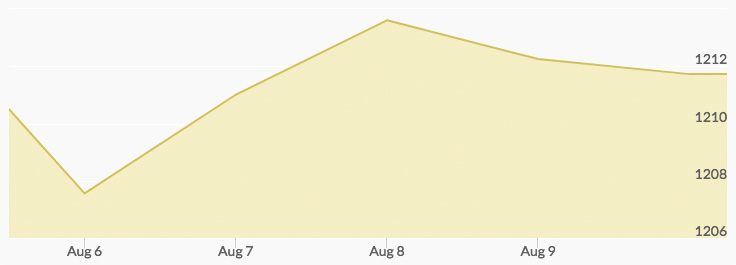

Gold’s market movers gained momentum and the dollar’s strength showed signs of slipping last week. Inflation and geo-economic risk rose, and the greenback fell, making way for the predicted breakout in gold prices.

Where are gold prices headed for the remainder of the year? Find out in “Gold Price Forecast 2018.”

Gold Price Movement Indictors

Monday, August 6, 2018

Stronger Dollar

Even a spike in gold buying in Iran ahead of the reimposition of U.S. sanctions at midnight on Tuesday couldn’t offset the impact of a stronger dollar and expectations of further interest rate hikes on Monday. Gold prices have been soaring in Iran as citizens hoard the yellow metal before banks financing the precious metals trade and brokers that sell gold and silver to the government face the threat of sanctions.[1]

However, in the rest of the world, many investors have been seeking safety from the escalating trade war in the dollar thanks to the Fed’s policy of continued interest rate increases through the end of the year. After two consecutive weeks of gains, the dollar rose again on Monday against a basket of currencies. ‘But that demand in Iran has not offset the selling of gold in the Western countries because of the higher (U.S.) interest rates and the higher U.S. dollar,’ explained the managing director of RBC Wealth Management, George Gero.

By afternoon trading, spot gold had pulled back .32 percent to $1,209.18. However, many experts don’t expect the dollar to weigh on gold prices much longer. Learn more in “When Will the Dollar Crash?”

Tuesday, August 7, 2018

Weaker Dollar

Prices for gold and other metals pegged to the dollar climbed on Tuesday as the dollar declined. The ICE U.S. Dollar Index lost .1 percent at 95.24. Gold prices hit a high of $1,215.20 at 6 am but pulled back in day trading to a low of $1,209.10 at 2 pm.[2] Out of all the forces that typically impact gold prices, the dollar has played a big role this year: while the dollar has gained 4.50 percent, gold has dipped 4.97 percent.[3] Read “How These 10 Factors Regularly Influence Gold Prices” to learn more about what moves the gold markets.

Experts, however, do not expect this pattern to hold. ‘We believe a reversal in gold prices is in the offing, as speculation of a trade war and Iranian sanctions are turning into reality. Further, record short investors positions in gold strengthens our conviction of a price recovery in H2,’ indicated analysts at ANZ.

Wednesday, August 8, 2018

Stronger Yuan

The dollar fell further, and the yuan rose on Wednesday, providing support for gold prices. ‘At the moment gold is more sensitive to the yuan than the dollar (index), so if the dollar is rallying but not against the yuan, gold is stable. The correlation (with the yuan) is almost one on one,’ explained commodities strategist at ABN Amro Georgette Boele.[4] Read more about how gold prices are determined.

Trading shaved another .1 percent off the ICE U.S. Dollar Index, bringing it to 95.16.[5] Last week, the People’s Bank of China indicated it would require banks to maintain reserves equal to 20 percent of the foreign exchange positions of their clients in order to stabilize the yuan.[6] The move contributed to a small rally in the yuan, which was more than .1 percent higher at 6.8140 yuan per dollar.[7]

The price of gold climbed from a 9 am low of $1,207.80 to a high of $1,214.40 at 11 pm.

Thursday, August 9, 2018

Rising Inflation

A tightening U.S. labor market, strong economy, and import tariffs are driving inflation higher, according to data released on Thursday.

- The U.S. Labor Department reported that during the week of August 4, 2018, initial claims for unemployment benefits dropped by 6,000 to a seasonally adjusted 213,000. During the week ending on July 14, claims fell to 208,000, the lowest reading since December 1969.

- In the second quarter, Gross Domestic Product grew at the fastest rate in nearly four years at 4.1 percent.

- Excluding trade services, volatile food, and energy, the Labor Department’s producers price index increased .3 percent in July.

- Intermediate prices for steel mill products jumped 1.6 percent last month for an annual rise of 12.4 percent.

What’s the best hedge against inflation? Precious metals in a diversified portfolio. Now is the time to buy gold and silver before prices soar amid escalating economic and political problems at home and internationally.

On Thursday, however, gold prices remained in the range they’d been trading in all week: the high of $1,214.70 at 2 am was followed by the low of $1,211 at 4 am.

Friday, August 10, 2018

Escalating Geo-Economic Risk

The last day of a week already marked by an escalating tit-for-tat trade war with China brought more geo-economic risk on yet another front. After the U.S. Trade Representative’s office released a finalized list of the $16 billion in Chinese goods it will levee a 25 percent tariff on, the Chinese Ministry of Commerce announced retaliatory tariffs of 25 percent on 16 billion in U.S. goods on Wednesday. These included motorcycles, passenger vehicles, and various fuels.[8]

Early Friday morning, Turkish President Recep Erdogan urged citizens to ‘change the euros, the dollars and the gold that you are keeping beneath your pillows into lira’ as the country faced ‘a domestic and national struggle.’ This prompted President Trump to double U.S. tariffs on Turkish steel and aluminum to 50 percent and 20 percent, respectively.

Following the announcement, the lira briefly plummeted 20 percent, shocking the international markets. The Dow dropped nearly 200 points, erasing its monthly gains. The S&P and the Nasdaq Composite lost .7 percent to close at 2,833.28 and 7,839.12, respectively. Bank shares declined at least 1 percent. Reports also surfaced that the ECB was concerned of how the record-low lira could impact banks across the Continent, particularly BNP Paribas, BBVA, and UniCredit.[9]

With its inverse relationship to the stock market, demand for safe haven gold spiked, sending prices to the weekly high of $1,216.20 at 11 am.

Need to know today’s gold prices? Check our Gold Spot Price Chart.