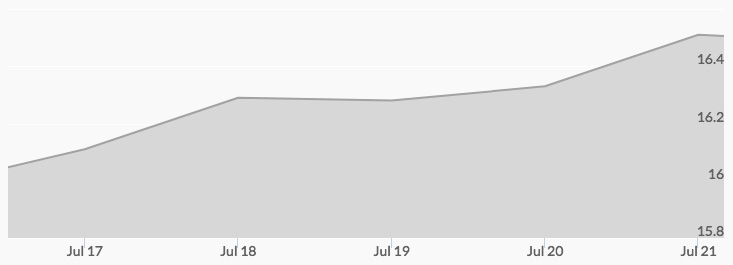

Monday’s opening bid for silver started the week at $16.19, and light trading in a narrow range brought the final quote in at $16.13. Aftermarket buying resulted in silver prices opening at $16.25 on Tuesday. The momentum continued, adding three cents to live silver prices for a close of $16.28 and a Wednesday opening of $16.33. The day closed at $16.30. Silver sales after the market close shaved off some pennies but bargain hunters brought in Thursday’s opening price on an upswing of $16.25. Steady buying drove the price of silver to a daily high of $16.39 before closing up at $16.32. The interest continued in aftermarket action to produce Friday’s opening price of $16.44, and buying carried the bid to $16.52 for the week’s high at the closing bell.

For buyers of silver, the news continues to point in a bullish direction for the white metal. Headlines, such as “Treasury Yields Fall to 2017 Low as Investors Seek Safety” and “The Dollar Gets Closer to Falling Off a Cliff,” are just a few of the economic indicators supporting risk-averse buying. 1 2 This is reinforced by news that the European Central Bank’s bond holdings are set to eclipse that of the Bank of Japan and the Federal Reserve. 3

Silver supply and demand news is also supporting buying. A recent report from The Silver Institute indicates that global mine production of the precious metal dropped in 2016—the first time in 14 years. Last year, the silver market experienced the third greatest supply deficit on record, which served to bolster prices. 4

This week, investors will be watching for the latest input from the Fed concerning interest rates, but there are no expectations for another increase. Inflation continues to be a concern of the policy makers, and they are unlikely to act until they have more data to inform the situation. Likewise, the advance numbers on GDP from both the U.S. and UK are not expected to produce any surprises or solid indicators as the market continues to sort out mixed signals on the global economic front. 5