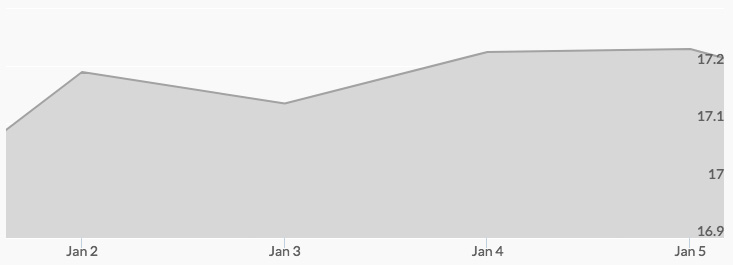

Silver broke the psychological barrier of $17.00 an ounce right at the open last week and stayed above it thereafter, reported the historic silver price chart. After markets were closed on Monday for the New Year’s Day holiday, they reopened Tuesday morning up at $17.09, $0.15 above the previous week’s close and then shot up to $17.20 by the close. Wednesday’s open slipped to $17.10 then rallied to close at $17.15. Thursday opened flat at $17.15 then moved quickly to $17.25 by 10:00 AM in New York, and finally closed at a more modest $17.21 after an active trading day. Friday’s open slipped to $17.16 but then exploded to hit $17.27 within the first hour of trading, finally settling to $17.22 to close the week up 1.5 percent over the previous week’s close.

Tuesday’s market opened to the news of a jump in global manufacturing demand. 1 Purchasing manufacturing indices from China, Germany, France, Canada, and the U.K. painted a picture of a global manufacturing economy in which producers are struggling to keep up with demand. The news was widely viewed as bullish for metals more broadly and silver specifically, given the metal’s use in a wide variety of industrial applications, such as renewable energy.

As the week continued, worries about a looming government shutdown on January 19 were compounded by concerns that GOP lawmakers are split on the Trump administration’s requirement that any budget deal include funding for a border wall with Mexico. 2 The proverbial ‘lines in the sand’ were perfect fodder for those who are worried about a stock market bubble, and these concerns were not helped by news that lawmakers in some states affected by the provisions limiting SALT (state and local tax) deductions in the recently passed tax bill are considering workarounds for their taxpayers. 3

The bullish news for silver and precious metals continued as a report by Morgan Stanley predicted a weak dollar in 2018, driven by increased overseas borrowing in dollars. 4 All signs point to a strong year for precious metals.