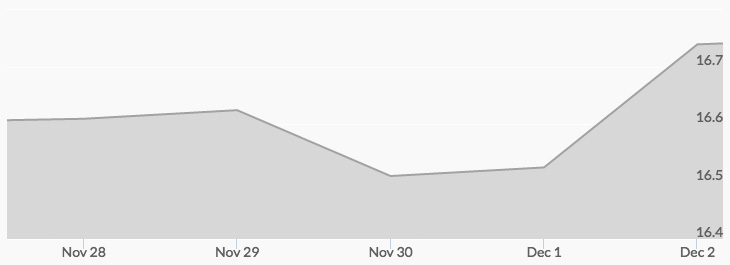

If you enjoy roller coasters, you got a thrill out of last week’s silver trading. Yet, the ups and downs ended the week essentially with the price of silver where it started: $16.53 per ounce, with the Friday $16.73 closing above 20% bulls. With a decline of 22% since the high of $21.13 hit in July, the market has shaken out a number of short-term speculators. 1

We noted last week that silver prices were reacting to resistance levels, and the lows were again tested at $16.32. The silver buying following that point indicated a strong demand going into this week. 2

In fact, many serious investors are enjoying the dip, giving them a chance to average down. Buyers of silver for the industrial and technology sectors are also taking advantage of locking in prices they feared they would not see again soon after this year’s strong run up.

The market responded positively to President Donald Trump’s appointment of Steven Mnuchin as Treasury Secretary and Wilbur Ross as Commerce Secretary. Similar to the president, both boast of plans to strengthen the economy. Such promises have swayed many traders despite still-looming national and global economic instability. This optimism for an improved economy is placing short-term downward pressure on all precious metals. 3

However, the long-term investor perspective supports higher prices in 2017, and underlines the opportunity now to add to portfolios at attractive silver prices. 4 Pressures on the supply and demand of silver could certainly send prices higher. 5 Significantly, the Silver Institute predicts global silver production will continue to decline through 2019. 6 This raises the question of whether we have reached the time of Peak Silver, with declining production at today’s silver prices.

The trading in the coming week will again show the market gambling on a mid-December interest-rate hike by the FOMC.