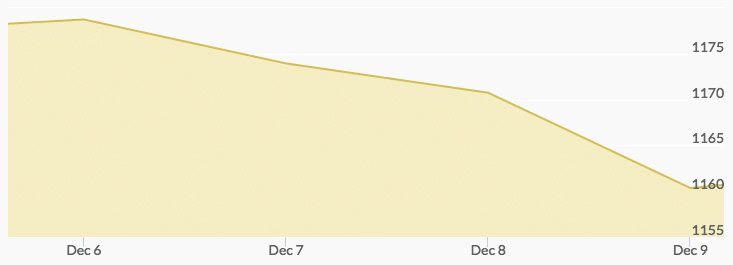

Gold prices continued to react to market pressures, opening at $1,169.90 per ounce. While that price point was under the previous week’s low, it firmed up to hit $1,170 on Wednesday. However, trading was volatile and trended downward from that high, closing on Friday at $1,159.28.

This trend has shaken a few of the newer and less experienced entrants to the market who don’t understand the realities of short-term trading cycles contrasted with the long-term market factors that influence the price of gold.

However, even some committed gold bugs were surprised by the lack of effect the results of the Italian referendum had on prices. With its serious potential impact on the euro and the European Union, the current news washed out these and several other market realities.

Two other major factors are affecting gold prices: one traditional and one unexpected. The potential of a rate hike from the FOMC meeting is exerting the expected downward pressure that comes from increases in interest rates. Analysts point out that any one increase is not that important, but any indication of a trend towards normal interest rates is.

The Fed has been seeking to raise interest rates after its initial bump last year. Despite that desire and plan, it has been unable to do so due to mixed signals from the U.S. economy. With the current environment created by President-elect Trump, most observers are betting on at least a small increase at the December meeting.

The unexpected aspect of the current gold trading environment is what is now being called the “Trump Rally.” The president-elect is signaling an earnest effort to cut taxes and regulations while spurring greater growth. This and his Cabinet appointments have equities setting historic highs. This trend reflects the normal market tendency to overreact to short-term factors and, as a result, camouflage deeper fundamental concerns, such as the Italian vote.

The coming week may be telling as the market reacts to the Fed minutes. The buying opportunities in gold prices is helping demand in areas like jewelry and for investments.