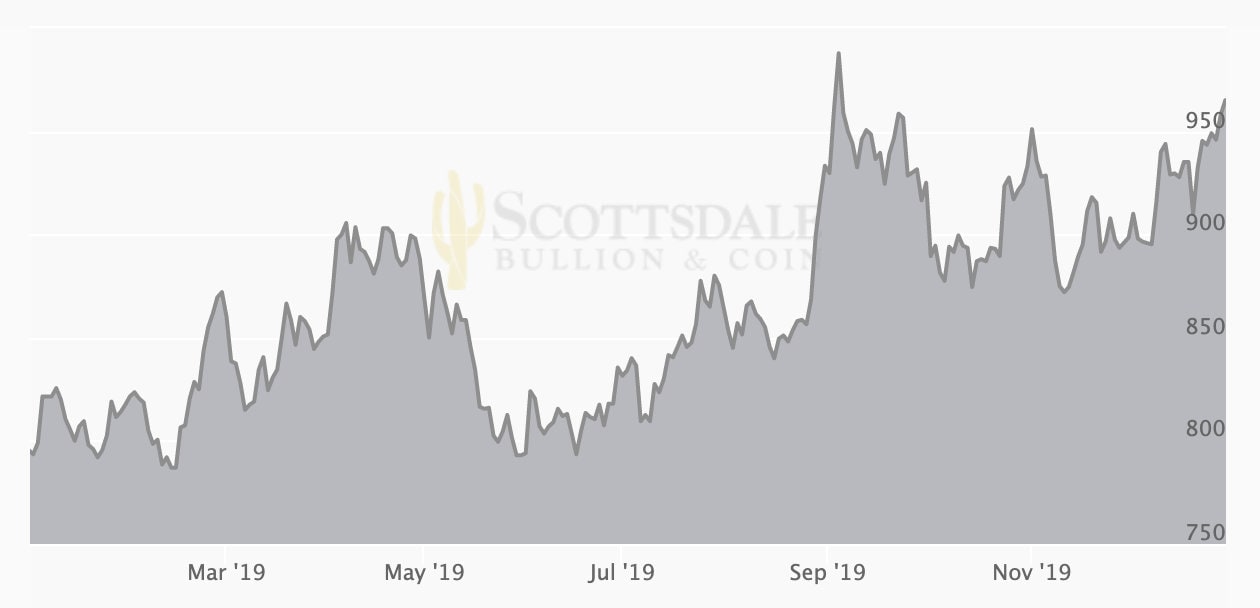

A 17% spike in the price of silver. An increase of more than 20% in gold prices. And the price of platinum? It outperformed gold and silver, notching over a 24% jump in 2019.[1] Not since 2009 has the precious metal seen such gains.[2]

Platinum’s Record Year

2019 Platinum Spot Price Chart

Everything you need to know to get started in Precious Metals

Learn how precious metals can strengthen your portfolio, protect your assets and leverage inflation.

These are impressive returns for the investors who had the foresight last year to buy precious metals. If only there’d been some way to know then what a good year 2019 would be to buy gold and silver and platinum.

Well, there were predictions: looking back at our Gold Price Forecast 2019, Silver Price Forecast 2019, and Platinum Price Forecast 2019, big banks and financial analysts were pretty bullish on all three precious metals.

What do they foresee for the price of platinum in 2020? Could the market hold the same potential for investors this year as it did last? Better yet, could platinum soar to its 2008 peak of $2,249 an ounce?[3]

Continue reading for the experts’ platinum price forecasts for 2020.

Platinum Price Predictions for 2020

Commodities will be outperformers in 2020 due to a host of fundamental macroeconomic factors… ‘Platinum would be number one.’—Wells Fargo’s Head of Real Asset Strategy, John LaForge[4]

Naturally, opinions about the expected price of platinum in 2020 can vary. While the price of platinum is not currently close to its all-time high, it rose enough during the year to give investors from early in 2019 a tidy profit and reasons for optimism.

The good news for current investors is analysts believe platinum prices are still low enough to offer room for future gains. How big?

Here’s what big banks and financial experts expect.

Financial Institution Platinum Price Forecast 2020

| Financial Institution | 2020 Platinum Price Prediction (per ounce) |

|---|---|

| World Bank | $890 |

| Commerzbank | $950 |

In its Commodities Price Forecast released last October, the World Bank predicted platinum prices to climb by 4% during 2020 to $890; however, at the January 23, 2020 platinum price of $1,004, the precious metal already surpassed this prediction.[5]

The bank cited increasing industrial demand, specifically for auto catalysts, and tightening mine supply due to financial fragility in South Africa as platinum price drivers.[6] More optimistically, the World Bank forecast an increase in the price of platinum of 64% to $1,300 by 2030.[7]

Commerzbank analysts predict the price of platinum to hit $900 an ounce by midyear and close out at $950.

After the spot price of palladium reached a record high of $2,556.95 an ounce in early January 2020, the bank’s analysts compared the metal to Icarus, the mythical Greek character whose wax wings melted when he flew too close to the sun, sending him crashing to the ground. They think tight supply and high prices for palladium will prompt the automotive industry to substitute it for platinum.[8]

Financial Institution Platinum Analysis

Silver and platinum have ‘some catching up to do,’ as these metals typically have better performance when global growth prospects heat up.—President of World Markets at TIAA Bank, Chris Gaffney

Fears of a global economic downturn drove investors to safe-haven assets gold and silver and away from industrial metals silver and platinum, explains Chris Gaffney, president of World Markets at TIAA Bank.

However, with growth expectations turning more positive and central banks around the world likely to hold rates steady in 2020, the manufacturing sector should rebound, lifting demand and prices for industrial metals platinum and silver. For example, some analysts forecast silver prices to hit $23 an ounce in 2020. Read more silver price forecasts for 2020. [9]

- Canadian bullion bank Scotia’s strategist Nicky Shiels attributes platinum’s recent rally to unwarranted speculation given the precious metal’s surplus supply over demand. Despite her current bearish view, Shiels predicts platinum’s market dynamics should shift starting this year due to declines in mine output from South Africa and a rebound in automotive sector demand.[10]

Industry Analyst Platinum Price Forecast 2020

| Industry Analyst | 2020 Platinum Price Prediction (Per Ounce) |

|---|---|

| Investing Haven | $1,100 |

| Rene Hochreiter (Noah Capital) | $1,000 |

| Thom Calandra (The Calandra Report) | $1,400 to $1,600 |

| London Bullion Market Association (LBMA) | $1,182 |

- One forecasting service, Investing Haven, predicts an 80% increase by 2022, simply because they expect the price of silver to increase. Historically, their analysts interpret charts to link rising silver prices as a leading indicator of increases in platinum’s price. They believe it’s possible for prices to pass $1,100 an ounce in 2020 and continue on an upward trajectory for the next couple of years.[11]

Yahoo Finance analysts foresee platinum prices catching up to those of gold soon. As of late January, the price of gold was at $1,577.74 an ounce, but experts forecast gold prices to keep rising in 2020, potentially to as much as $3,000 per ounce.[12] Read expert gold price forecasts for 2020.

Even though they admitted the market has been somewhat volatile in the past few years, they believe price trends support a platinum rebound, citing the 2019 pattern of higher lows and higher highs for platinum, as well as the fact that platinum prices were typically double gold prices during the 2000s.

- Rene Hochreiter works as an analyst for Noah Capital. He thinks that increased demand for palladium will result in steeper prices. In turn, catalytic converter producers will substitute for platinum, driving up its price, as well. His spot price of platinum forecast for 2020 included at least breaking $1,000 per ounce, continuing to rise to $1,700 per ounce within another year, and hitting $2,000 per ounce by 2023.[13]

- Thom Calandra produces a report on speculative natural resources and industries called The Calandra Report. He believes the price of platinum in 2020 should range from $1,400 to $1,600 per ounce, which is closer to the palladium price.

Rohit Savant, the CPM Group’s vice president of research, predicted 2020 platinum prices to remain about the same as 2019 prices or move higher. Platinum is currently underpriced and of great interest to investors.

Demand for the metal could be hampered on the industrial side during 2020 by a sluggish general economy, an end to the labor strike in South Africa, and a constriction of the diesel passenger vehicle market.[14]

- The much-anticipated results of the London Bullion Market Association’s delegate poll revealed a platinum price forecast for 2020 of $1,182 per ounce. Like analysts at Yahoo Finance, the LBMA delegates think platinum will be playing catchup this year. Considering how prescient their precious metals price forecasts for 2019 proved, the LBMA forecast is one to watch.[15]

- Although the price of platinum could pull back to $862.29 per ounce this year, by 2025 investor blog Gov Capital’s deep learning algorithm suggests the price could reverse course significantly to $3,689.74 per ounce—presenting an irresistible investment opportunity.[16]

Where Do You Think Platinum Prices Are Headed in 2020?

Share Your Platinum Price Prediction for 2020 here:

Market Factors for Platinum Prices in 2020

As with any commodity, supply and demand influences the platinum price. This includes the demand for such applications as jewelry and catalytic converters; however, as we saw in 2019, investor demand can play a key role, as well. Investors buy precious metals as a safe-haven when their confidence in riskier markets, such as stocks, wanes.

Platinum Supply and Demand

It is encouraging to see investment demand for platinum growing rapidly in 2019, and we expect this trend to continue. We believe our ongoing efforts in product development through global partnerships, plus platinum’s discount to gold, will support continued, solid retail investment in bars and coins.—CEO of the World Platinum Investment Council (WPIC), Paul Wilson[17]

Increased Platinum Demand and Tighter Supply

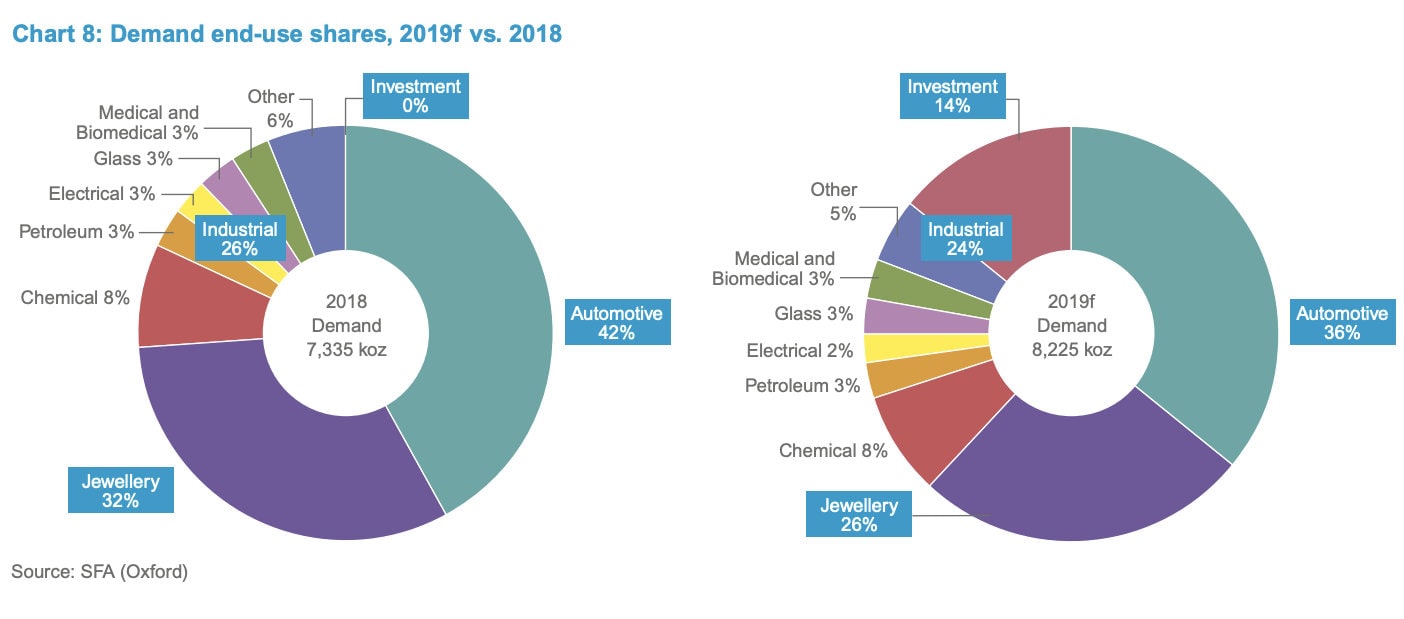

- In 2019, the World Platinum Investment Council (WPIC) revised their forecast from a 345,000-ounce surplus to a 30,000-ounce deficit.[18]

- Investment demand for platinum increased 14% from 2018 to 2019, while the industrial, automotive, and jewelry sectors experienced slight pull backs in line with a slowing global economy. Overall, all segments consumed 890 more koz of platinum in 2019 than in 2018.[19]

- The increase in investment demand was especially salient in the ETF market, where investor holdings ballooned by 30%, the highest ever recorded.[20] Large institutions accounted for much of the buying. Since they usually take two- to three-year views on positions, the purchases suggest they see value opportunity in platinum, potentially from future supply constraints and demand growth.[21]

- As of November 2019, platinum coin and bar purchases tallied 1.095-million ounces. [22]

2019 vs 2018 Platinum Demand Breakdown

Source: SFA (Oxford)

Industrial Demand for Platinum

The Earth’s crust has only five parts of platinum per billion, so it is very rare—along with palladium, rarer than silver and gold. In fact, all the platinum ever produced could fit inside a typical living room. Palladium is even scarcer.[23] Perhaps that’s why these two precious metals often appear to fly beneath the radar.

Still, a great percentage of the demand for these two metals comes from industry. Industries use platinum for a variety of applications, including:

- medicine

- pacemakers

- magnets

- catalytic converters

- fuel cells

- electrical contacts

They rely on platinum and other precious metals despite their steep cost because they can’t find cheaper replacements. If companies could use less expensive materials, they would. Thus, their dependence on precious metals creates a floor for demand.

One exception to this rule might be the replacement of palladium with platinum for such applications as catalytic converters. As of late January, palladium cost $2,302 an ounce, but at times, platinum has been the more expensive metal.[24]

Economic Factors Fueling Platinum Demand

Gold and silver tend to get more attention than other precious metals, even platinum. Currently, the market for all the rare metals is rising because they’re regarded as a safe-haven investment during times of political and economic uncertainty. When investors begin to pay attention to popular metals, like gold and silver, they also notice others.

Focus Economics analysts believe the market for precious metals will stabilize and strengthen in the next year because of optimism about U.S.-China trade relations and an improving outlook for the global economy.[25] These factors should lift industrial demand, while they expect continued geo-political and economic uncertainty to fuel safe-haven buying. In the case of precious metals, a rising tide tends to lift all boats.

Is Platinum a Good Investment in 2020?

We can’t guarantee any prediction for the price of platinum this year. We do know that current platinum prices are nowhere near their historic highs. Even though platinum used to cost more than gold and palladium, it’s less expensive right now. There was a supply deficit this year, and analysts foresee limited supplies in the future. Platinum prices have trended upwards during 2019, and many analysts predict them to keep rising.

What do these factors suggest? Compared to the past, platinum is a bargain. Investors who want to get into the market may see healthy returns if prices continue to rise as predicted.

To learn more about investing in platinum, gold, and silver, you can get our free guide to investing in precious metals.