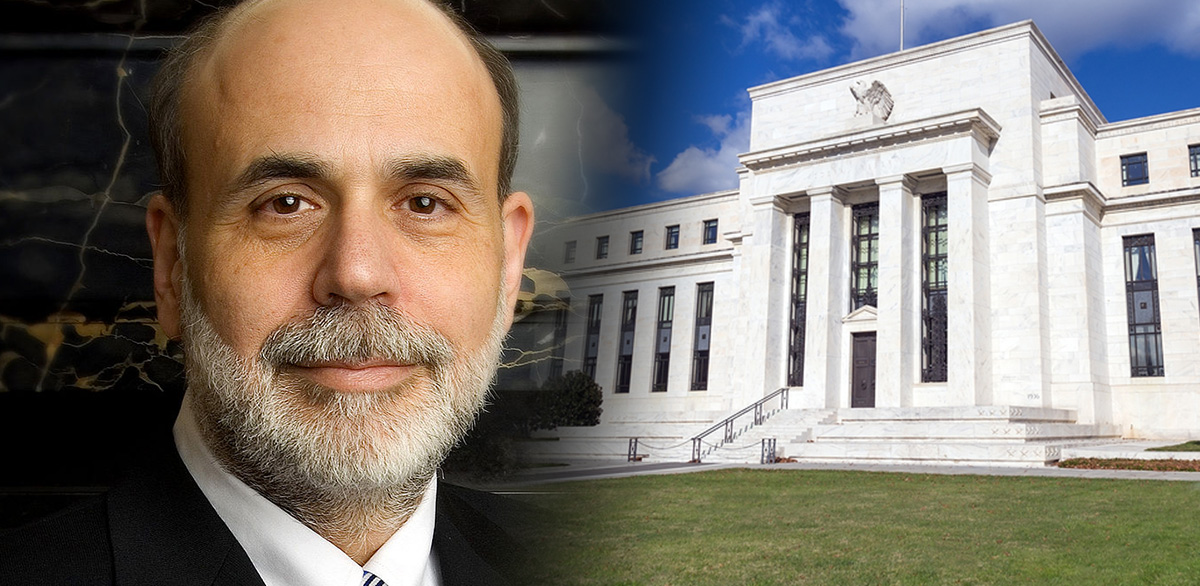

When Ben Bernanke, two-time chairman of the U.S. Federal Reserve speaks, the markets listen closely. That makes the recent comments on his blog at the Brookings Institute of special interest to those who buy gold and trade in precious metals. As Bernanke discusses, are negative interest rates on the table for the U.S.?

We’re Running Out of Options, Says Bernanke

In addressing the possibility of future economic trouble, Bernanke uses the metaphor of a toolbox, discussing what options the Fed and other agencies might take to respond to further financial issues. He points out that most of the preferred and highly effective methods of manipulating the economy by monetary means have been already used and are simply no longer available. This includes significant lowering of short-term rates and the use of more quantitative easing.

The blog is a good read and covers a number of points of interest to anyone who invests in gold and precious metals. However, the most significant concept introduced is the idea of negative interest rates as a real possibility in the United States, since we have run out of other options.

Building a Case for Future Action

Anyone who follows the Fed (and the Federal Open Market Committee) understands little is said publicly without careful planning and consideration of how it will be heard and received by the financial markets. This is even addressed in this blog by Bernanke, when he states, “…FOMC could next turn to forward guidance, that is, to communicating to markets and the public about the Fed’s policy plans.” There has been a great deal of that over the past two years about potential rate increases, not all of it handled smoothly.

Taken in that light, Bernanke’s comments could be seen as a very carefully planned first step to prepare the U.S. and global markets for more bad financial news. While the introduction is very careful to not paint a negative picture, the sum of the material presented acknowledges that there is a very real and persistent potential for more economic troubles in the near and not-too-distant future.

If one sees the current situation as purposeful conditioning of the markets for such a step (previously viewed as quite drastic, but now a reality in several large countries), it is worth understanding what the possibility of a negative interest rate means.

Negative Interest Rates and Gold

The first thing to remember in any discussion of interest rates and gold is that many gold buyers see a direct correlation between interest rates and the price of precious metals. Since gold does not generate a current return such as dividends or interest, it is often eschewed when rates are high. As interest rates decline, and especially because of dark economic clouds, gold becomes increasingly attractive to those who buy precious metals and seek havens for their holdings. What would happen to the price of gold if the U.S. were to institute a never-before-seen negative interest rate policy, as has recently been employed in other struggling economies like Japan?

As Bernanke himself notes, a lot of the power of the Fed comes through working to set market expectations. Currently, they continue to focus on interest rates that will support and stimulate the still-limping economy. If or when negative interest rates become a reality, it will be even more incentivizing for investors to move wealth into assets that do not penalize the holder. In this scenario, we can expect greater demand for gold and precious metals. 1

This is certainly an issue that bears very close watching over the coming months, and it will enter into the discussions about expected FOMC actions at near-term meetings.

Additional Sources