Invest in a company’s debt and you own stock; invest in a nation’s debt and you own bonds. The two serve as excellent, but very different, mechanisms for wealth accumulation. While companies can only manipulate the value of their stock prices by strong or poor performance, governments can manipulate bond prices by increasing or decrease the value of their currency.

At the same time that the US government prints money as fast as possible, US bonds trade at record low prices, from a fraction of a percent in the short-term and just one or two percent over the course of a decade. In fact, the only nation with a positive bond differential is the one doing the most to solidify its currency: China.

Central Bank Gold Reserves

There’s supposedly about a quarter of a trillion dollars in Fort Knox, Kentucky, under lock and ample guard. While this is far from pocket change, it’s only a fraction of the $1.2 trillion dollars in American currency traveling throughout the world. The ratio between our gold and our currency may seem low, but it’s twice better than that of our largest trading partners.

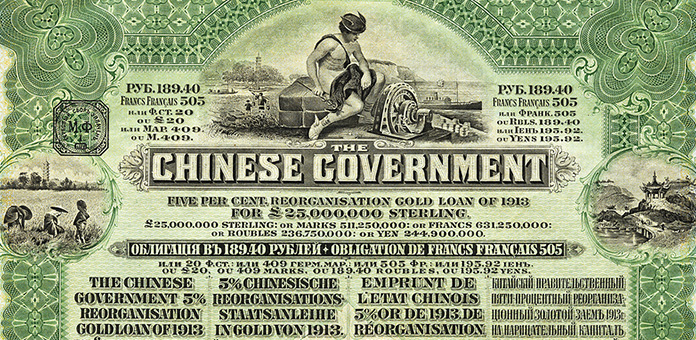

The Chinese reportedly have about sixty billion dollars in gold reserves, but about six hundred billion dollars in yuan notes. The country’s most recent five-year economic plan laid out ambitious notions, including making it into the World Bank’s listing of rich countries, which will require much more borrowing, much more credit, much higher bond yields, and most importantly much more gold. 1 Only Russia has added more gold to their central bank in the past decade than China, resulting in government debt that’s suddenly one of the hottest values on the market.

Brexit and Chinese Bonds

Fidelity International recently advised investors to pick up Chinese bonds, not only due to the large gold spending spree but also due to the imbalance in the bond market resulting from Britain’s EU referendum (popularly known as “Brexit“). Investors are looking for safe (or safer) bond haven markets, and none shine as brightly as China due to the rapidly increasing public debt and the governments’ stimulus projects leveraged to keep the country’s strong economic growth stable. The bottom line, as voiced by London-based Insight Investments, is a rare market with positive yields.

Brazil’s Hopeless Debt

If China is benefiting from the growth in bond yields, who is experiencing the opposite fate? Brazil, it seems, has overtaken Greece for the title of most hopeless debt. The Brazilian economy has contracted by more than five percent in the past twelve months, a crippling combination of diving commodity prices and a national corruption scandal that has buried the career of president Dilma Rousseff. 2

Ten year-yields have reached negative figures in Germany, Japan, and Switzerland, suggesting that there’s no need to spend the Euro, yen, or franc today because it’ll be worth more tomorrow. China hasn’t cut their interest rates since October, indicating a massive push to attract more outside investment and take on more debt.

Gold Holds Value to All

The value of the yuan slid to five-year lows at the end of June. 3 The yuan still needs a crutch, meaning that China will continue to snap up more gold. At a time when almost every global currency is taking it on the chin, investors have realized how valuable gold is as a safeguard. And until central banks stop solving financial problems by printing money, that safeguard will be the best investment on the market.

Additional Sources

2 – http://www.bbc.co.uk/news/business-36425427

3 – http://www.bloomberg.com/news/articles/2016-06-20/in-a-world-of-below-zero-bond-yields-china-debt-bucks-the-trend