Gold has historically been considered a safe investment. However, for those who were looking at short-term gains on gold in 2013 that was not the case, with the US economic recovery catching steam and the equity markets taking off. Consequentially, gold values plummeted last year, which in fact has made gold an attractive investment opportunity. China continues to buy the precious metal at prices close to $1,200 or lower, and this powerful country’s support is fostering the market’s confidence in gold. It’s time to take advantage of the depressed price of gold and consider dollar cost averaging into gold.

The price of gold rose steadily from 2001 to 2012 as investors were looking for safe havens in turbulent markets across the world, according to a recent article in the Associated Press 1. The gold price peaked in the summer of 2011 at $1,900, which coincided with the height of uncertainty regarding government budget debates and general sentiment of frustration towards the government’s handling of the economy. Yet, gold experienced the most drastic drop since 1981 during the following two years, at a current price of $1,202.

However, China is quickly becoming the world’s leading gold buyer, according to Bloomberg Businessweek. Chinese gold purchases during the twelve months leading up to September 2012 increased by 30%. One of the biggest reasons for this hike is that Chinese citizens don’t actually have many investment options. The average person has easy access to gold, and that liquidity is very attractive in uncertain political environments. The population is becoming wealthier due to China’s economic boom, which is fueling the gold demand in the country.

While the US economy continues to recuperate, the pace of the recovery process is accelerating. This is lending to the idea that inflation is starting to set in. There’s a saying that rising tides bring up all boats, and gold will definitely be one of these “boats.” The Bureau of Labor Statistics reported that the unemployment rate has been dropping steadily, constituting around 7%, which is well below the high of 10% in 2009. The base unemployment level, called frictional unemployment, which exists because people switch jobs, is generally thought to be around 4%-5%, and it has been trending toward that point.

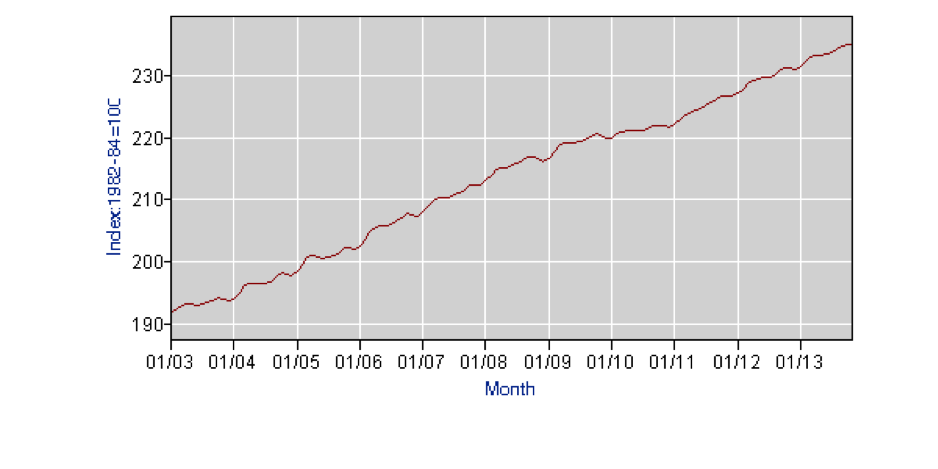

Furthermore, the BLS states that the consumer price index (the market basket of goods and services) has been on a continual rise, even during the recession. The price increase of the basket of goods did slow down a bit, but the purchasing power of the dollar has been decreasing as well.

The Bureau of Economic Analysis reports that the quarterly GDP has increased from 0.1% in Q4 2012 to 4.1% in Q3 2013. The steam is picking up.

This all leads to the conclusion that the steep fall of the gold price harbors great opportunities for investments at a bargain price. The US economy is solidly recovering, and foreign countries are buying gold at a greater pace. When the inflation rate is rising, people tend to favor safe-havens and gold is still relatively attractively priced. It is time to start dollar cost averaging into gold. You can take advantage of the low gold price or buy at greater discounts if it drops even more. History has shown that the demand for gold rises over time. Thus, you will put yourself in a great position once the pendulum swings back and gold is in high demand again. There are many ways to invest in gold, and physical gold like rare and investment coins tend to be the safest option.

Learn How to Avoid Rookie Mistakes When Investing in Gold Coins.

Learn How to Avoid Rookie Mistakes When Investing in Gold Coins.

Get our Free Gold Investment Guide Now – Click Here.

Additional Sources