At this point, nearly every investor is familiar with the idea that gold is a reliable hedge against inflation. It’s a widely accepted principle in the world of finance, often repeated without much examination.

At this point, nearly every investor is familiar with the idea that gold is a reliable hedge against inflation. It’s a widely accepted principle in the world of finance, often repeated without much examination.

Diving into the relationship between gold and inflation can help clarify this precious metal’s role in protecting your nest egg from economic volatility, currency instability, and market downturns.

What happens to gold in recessions?

The first step in assessing the merit of gold as an inflation hedge is looking at the yellow metal’s performance during recessions. The value of the US dollar is a reliable indicator of inflationary periods. As the standard unit of trade, the greenback’s value accurately tracks the rate of inflation present in the broader economy.

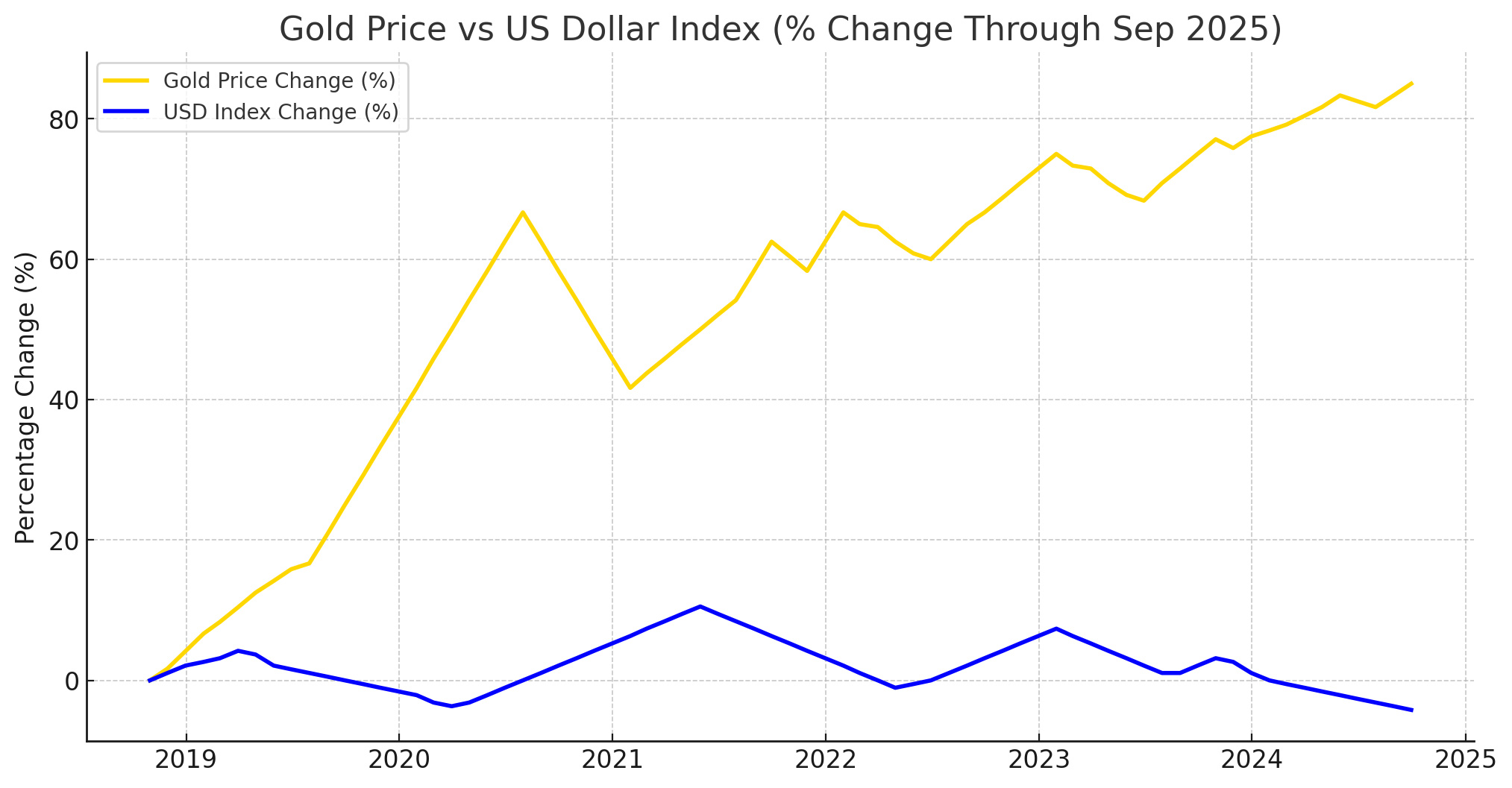

The graph below shows the contrast between the price action of gold (yellow) and the dollar (blue) for the last five years. Gold and the USD have an inverse relationship, which means their values tend to move in opposite directions. When the dollar depreciates, gold prices tend to rise. Conversely, when the dollar’s buying power increases, gold prices usually cool off.

This negative correlation is particularly strong during periods of acute economic downturn, such as in the Great Recession of 2008 and the aftermath of the COVID-19 recession in 2020. These are precisely the periods when inflation protection is essential, as standard dollar-backed assets such as stocks and Treasuries tend to lose significant value.

Gold Keeps Pace With Inflation

Gold is often described as a hedge against inflation, yet this phraseology doesn’t clearly describe how this yellow metal protects wealth. It’s more accurate to say that gold tends to keep pace with inflation.

The value of gold has remained remarkably stable over thousands of years. In ancient times, an ounce of gold was enough to buy a tailored suit or pay a modest month’s rent. Amazingly, the same amount of gold can purchase those essentials today, reflecting gold’s strength as a long-term store of value.

Let’s explore one of those examples in greater depth. In the early 1900s, one ounce of gold was worth about $20, roughly the price of a high-quality tailored suit. Today, with gold trading around $3,400, that same ounce can still buy a custom suit from a reputable tailor.

Despite the acute devaluation of the dollar and a staggering increase in living costs, the value of gold has remained remarkably stable, consistently preserving its ability to purchase the same quality of goods over time.

Gold goes up very aggressively as inflation increases.–

Which types of gold offer the best protection against inflation?

When it comes to using gold as an inflation hedge, not all asset types are built the same. Some forms of gold offer greater wealth protection than others, based on their inherent value and relationship to the broader market.

Paper Gold

Paper gold, in the form of gold ETFs, mutual funds, and mining stocks, is closely linked to the US dollar and the stock market. While designed to track the physical price of gold, these assets more closely mirror financial markets and corporate performance, leaving them subject to economic whims. As a result, these assets are highly susceptible to inflationary pressures.

Physical Gold

In contrast to their paper counterparts, physical gold assets offer investors direct exposure to gold. Generally, gold coins, bars, and bullion have an inverse relationship with the rest of the economy. These assets often increase in value as inflation diminishes the value of USD-linked assets.

Gold IRA

One of the best ways to use gold as an inflation hedge is through a precious metals IRA. Also known as a gold IRA, these self-directed plans marry the tax advantages of standard retirement accounts with the inherent value of physical gold assets. Individuals get the best of both investing worlds by putting tax-advantaged dollars towards physical assets with inherent value and inflation protection.

Why Gold is a Reliable Hedge Against Inflation

Knowledge of gold’s tendency to rise as the dollar falls explains how it counteracts inflation, but it doesn’t fully explain why this inverse relationship persists. The yellow metal boasts many special properties and features that give it lasting power to preserve wealth through economic shifts.

Inherent Value

Gold’s inherent value provides the foundation of its ability to keep pace with inflation. In contrast with paper assets, which are at the mercy of various market conditions, physical gold’s value is intrinsic.

This independent value derives from a slew of characteristics that are unique to gold, including:

- Historical significance: This metal has served as a trusted store of value for thousands of years.

- Natural scarcity: With a naturally limited gold supply and an inability to be manufactured, gold preserves long-term demand and value.

- Tangible form: As a physical asset, gold holds value outside of digital or paper-based systems, protecting prices from inflationary pressures.

- Practical applications: Outside of investing, it holds lasting value due to its widespread use in jewelry, electronics, and industry, helping to sustain demand across market cycles.

- Economic functionality: The yellow metal is relied on as a reserve asset and medium of exchange in times of crisis.

- Global acceptance: Gold is a highly liquid and universally trusted asset, being widely held by investors, financial institutions, and governments alike.

Historical Significance & Performance

Since ancient times, gold has consistently been seen as a store of value, a means of exchange, and a core component of currency. This historical significance has largely contributed to gold’s status as a valuable investment asset.

Since ancient times, gold has consistently been seen as a store of value, a means of exchange, and a core component of currency. This historical significance has largely contributed to gold’s status as a valuable investment asset.

Over time, this reputation as a safeguard of wealth translated into consistent performance as investors would pour into precious metals during periods of economic downturn. In fact, the dollar has lost 99% of its value compared to gold since the abandonment of the gold standard in the 1930s.

Limited Supply & High Demand

Gold exists in limited supplies on Earth and cannot be synthetically produced. As a finite resource, gold is immune to harmful monetary policies such as overspending and overprinting that inflate fiat currencies. There’s no golden goose fiscal leaders can rely upon to generate more physical gold, which, in turn, ensures the stability and growth of gold’s value.

This natural scarcity, in tandem with a millennia-long track record of global demand, maintains and drives up the price of gold. As central bank gold demand reaches record levels and supplies are squeezed, gold’s value will only increase.

Universal Acceptance

Gold enjoys virtually universal acceptance with central banks, institutions, and retail investors around the world trading it consistently. This widespread recognition of gold’s worth increases its demand, liquidity, and value.

Unlike most tangible assets, physical gold is relatively easy to buy, sell, and trade, given its widespread recognition and acceptance. No matter which currency is experiencing inflation, investors tend to rely on gold to maintain the value of their wealth. Gold’s performance transcends economic and cultural boundaries.

Physical Ownership

One of the main reasons investors have extolled gold as an inflation hedge over time is its tangibility. There’s a critical sense of security, stability, and confidence that comes with physical ownership.

People will justifiably trust their hard-earned money with themselves before the government. Although there are paper gold assets, physical products are less susceptible to broader market conditions given their inherent value.

Gold’s Rise as a Permanent Inflation Hedge

The familiar cycle of rising gold prices during inflationary spikes and falling prices during calmer periods is beginning to shift. Inflation is no longer a temporary surge but a more entrenched feature of the global economy, driven by the weakening of the US dollar through de-dollarization, mounting national debt, and persistent fiscal mismanagement.

As demand wanes for the dollar around the world, that means more and more dollars are going to be coming back to the US. The inflation we’re already experiencing is just going to compound.–

At the same time, central banks are steadily reducing their reliance on the dollar and turning to physical gold as a reserve asset. This structural change is reflected in gold’s elevated role within the global financial system, where it now holds Tier 1 collateral status.

This shift can be seen in how inflation and gold prices have moved in recent years. After the pandemic, inflation rose to levels not seen in decades, and at the same time, gold reached record-high prices. That upward trend in gold hasn’t stopped, highlighting a deeper change in how the market views both inflation and the role of gold.