Gold is often touted as a reliable hedge against inflation. Investing wisdom suggests gold has the unique ability to maintain and even gain value during periods of economic downturn. Does gold really live up to the hype or are investors putting their wealth at risk? Let’s take a deep look at what happens to the price of gold during recent recessions to better understand this precious metal’s performance amidst the backdrop of the broad economy.

Gold is often touted as a reliable hedge against inflation. Investing wisdom suggests gold has the unique ability to maintain and even gain value during periods of economic downturn. Does gold really live up to the hype or are investors putting their wealth at risk? Let’s take a deep look at what happens to the price of gold during recent recessions to better understand this precious metal’s performance amidst the backdrop of the broad economy.

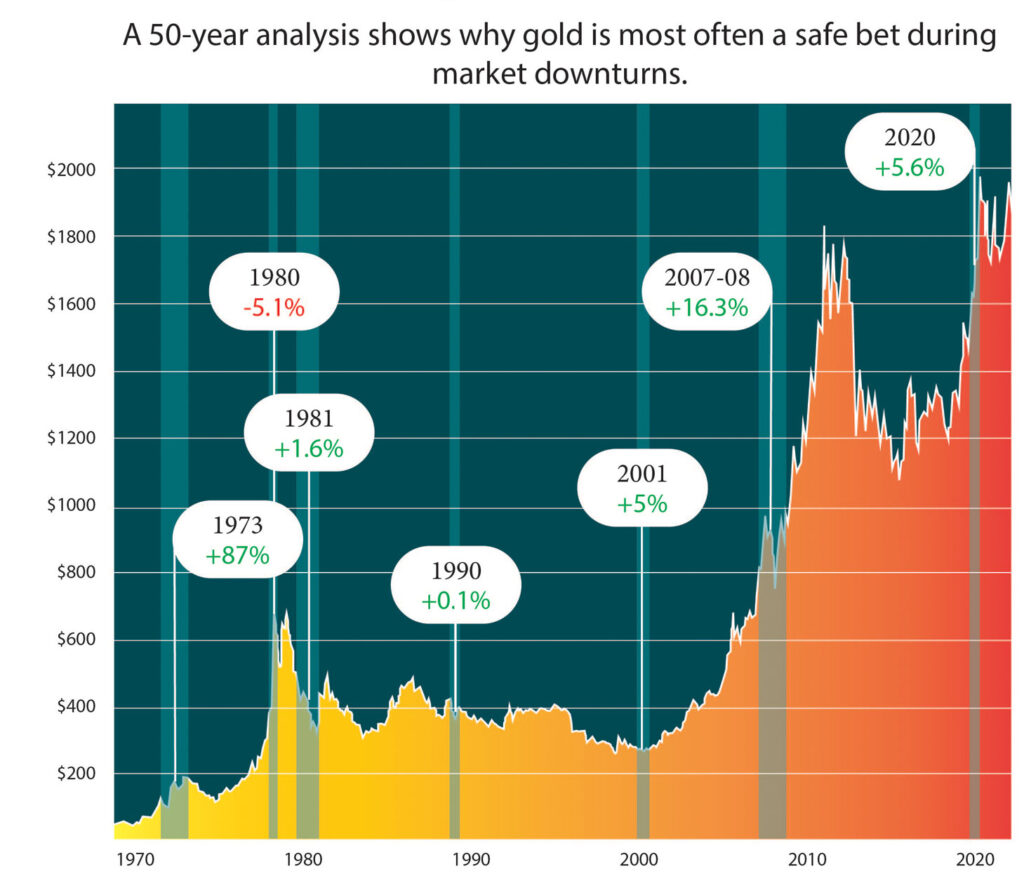

Gold Prices During US Recessions (1970–2023)

Although there are numerous ways to determine a recession, the National Bureau of Economic Research defines it as the economic downturn between the most recent height of economic activity and the consecutive lowest point. Following this definition, the US has undergone eight recessions in the past five decades.

The Guns and Butter Recession (December 1969–November 1970)

Cause: The US government’s excessive spending in the Vietnam War drove up prices at home. In response to high inflation, the Fed increased interest rates which put further pressure on the domestic economy. This relatively mild recession ended one of the longest economic expansions in the US economy.

Gold Price Reaction: From December 1969 to November 1970, the value of gold dropped by 12.73% . However, this slight dip was followed by a years-long surge that lasted through the summer of 1973. During this time, gold prices more than tripled going from a low of $36.56 to a peak of $120.20/oz.

The Oil Crisis (November 1973–March 1975)

Cause: In retaliation for the US support of Israel in the Yom Kippur War, OPEC issued a massive oil embargo which had widespread economic ramifications. The US was already struggling with currency devaluation and President Nixon’s decision to end the gold standard. The fallout ushered in a period of severe stagflation.

Gold Price Reaction: Following a huge rally at the beginning of the ‘70s, gold prices took a short breather. The dollar’s divorce from a gold-backing was initially intended to stabilize the US economy, but the Nixon shock instead acted as a tailwind for gold prices. Throughout the recession, gold jumped from $95.22 to $178.04/oz, representing an 87.05% increase in value.

The Volcker Recession (January 1980–July 1980)

Cause: Despite its short duration, this recession was widely regarded as one of the worst recessions to hit the world economy at the time. It was sparked by the 1979 Iranian Revolution and the ensuing energy crisis. The recession often bears the name of the Fed Chair who infamously ramped up interest rates to record levels.

Gold Price Reaction: Within the six-month recession, gold prices dropped slightly from $677.97 to $643.46/oz. This 5.09% decrease was relatively strong given the severity and swiftness of the Volcker recession. By September of 1980, gold prices had already regained most of their losses throughout the downturn.

The Volcker Recession 2.0 (July 1981–November 1982)

Cause: The US economy hadn’t yet fully recovered from the previous recession when the Fed’s austere economic policies proved too burdensome. Inflated consumer prices and high borrowing costs drove unemployment over 10%.

Gold Price Reaction: During the recession of 1981 to 1982, gold prices grew modestly from $408.61 to $415.21/oz, notching a 1.61% climb. However, the real gains were delayed until 1983 when gold hit $488.75/oz which represented a nearly 20% gain since the beginning of the recession.

Gulf War Recession (July 1990–March 1991)

Cause: A number of unrelated factors converged to create this US-concentrated recession including the savings and loans crisis, a massive drop in real estate construction, and another shock in oil prices caused by the Persian Gulf War.

Gold Price Reaction: When lined up directly with the recession’s timeline, gold prices only rose 0.1% from $362.85 to $363.23/oz. However, a closer look at gold’s price action reveals a considerable surge immediately following the start of the recession. Between July and August of 1990, the value of gold jumped by nearly 9% .

The Dot Bomb Recession (March–November 2001)

Cause: Throughout the late 1990s, investments poured into up-and-coming tech companies. Eventually, the resulting dot-com bubble popped. The recession primarily hit developed nations where markets were heavily invested in new technology. The fallout from the 9/11 attacks also contributed to the downturn.

Gold Price Reaction: Throughout the Dot Bomb, gold prices rose from $263.03 to $276.16/oz, marking a respectable 4.98% increase. This steady rise would eventually give way to another record-setting price swing. Between November 2001 and November 2007, gold prices nearly tripled once again, reaching $806.25/oz right before the next recession.

Global Financial Crisis (December 2007–June 2009)

Cause: The 2008 Global Financial Crisis, perhaps the worst economic catastrophe in recent memory, resulted from a giant housing bubble in the US. Loose government regulations drove subprime home loans which homeowners couldn’t pay back. This triggered consecutive crashes in the real estate market, stock market, and banking sector.

Gold Price Reaction: The drastic economic downturn was mirrored by a sharp uptick in gold prices which soared from $803.20 to $934.50/oz. This 13.24% increase was just a snapshot in a larger price move which took gold prices to record territory with a peak of $1,825/oz in August 2011.

COVID-19 Recession (February–April 2020)

Cause: The most recent recession was triggered by excessive government printing and spending in the wake of the COVID-19 pandemic, resulting in record-setting inflation and currency devaluation. Lockdown policies and supply chain disruptions further hamstrung the economy.

Gold Price Reaction: Within these two months, gold prices gained 5.56% of value jumping from $1,626.34 to $1,716.75/oz. Although the 2020 recession is technically over, uncertainty and instability still pervade the global economy. Central banks are buying gold at record rates to protect against anticipated turbulence. Gold actually hit record highs in 2022 with an average price point of $1,750/oz.

The United States has experienced numerous recessions since its founding, so why only focus from the 1970s onwards? America officially abandoned the gold standard in 1973 which decoupled the US dollar from gold backing. This drastic move has worked to strengthen the inverse correlation between gold prices and overall economic performance. Plus, focusing on recessions within a fiat-based economy paints a more accurate picture of what investors can expect. After all, a return to the gold standard is highly unlikely.

Why Gold Provides Protection in Recessions

Gold can be a reliable hedge against inflation due to its scarcity, inherent value, and universal recognition. These unique characteristics make gold an ideal asset to hold during recessions as inflation rises and currency devalues. In fact, gold has yielded higher returns than the stock market in six of the past eight recessions. In total, investors saw 37% greater returns from this precious metal when compared to the S&P 500.

It’s important to keep in mind that there’s nothing guaranteed or predictable in the world of economics. As you can see from the analyses above, gold prices didn’t always increase immediately following an economic downturn. Furthermore, there were times when the value of gold actually decreased along with traditional markets.

However, when compared to other investment vehicles, gold has a centuries-long track record of providing wealth protection no matter what happens in the broader economy. As a result, this precious metal has become a staple for investors looking to diversify their portfolios. With experts warning of further economic turbulence on the horizon, smart investors are already stocking up in preparation for the next recession.

If you’re interested in learning more about investing in gold, claim a FREE copy of our Precious Metals Investment Guide.