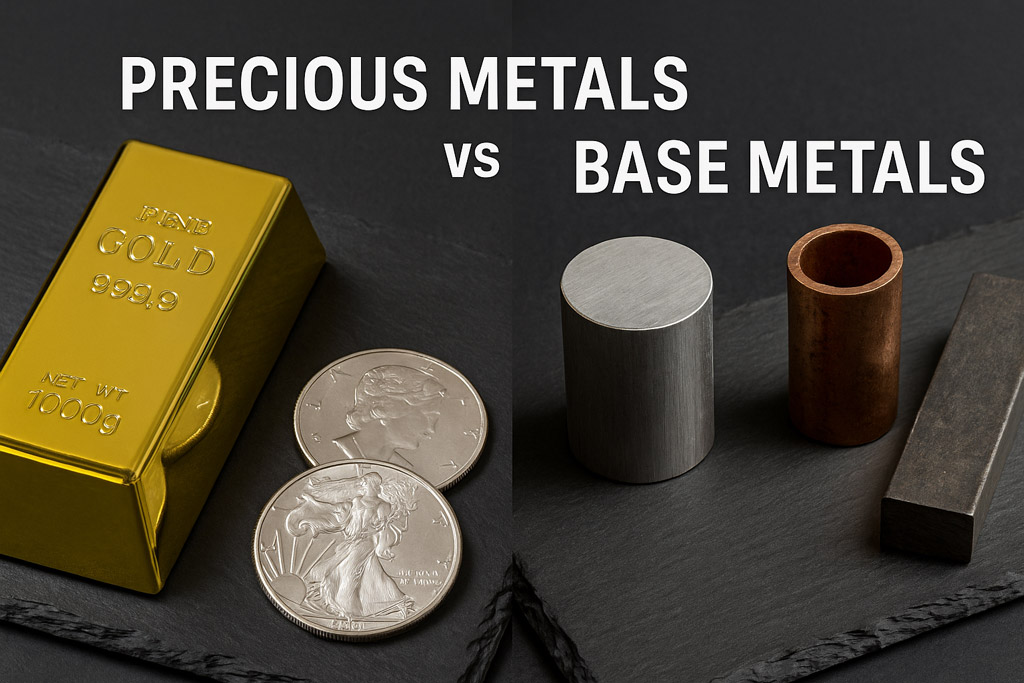

While researching precious metals such as gold or silver, investors inevitably come across the term base metals. The subtle yet critical differences between these elements determine which physical metal assets are valuable and worth holding as investments. Understanding the nuances between precious metals and base metals sheds light on the dynamic landscape of gold and silver assets.

While researching precious metals such as gold or silver, investors inevitably come across the term base metals. The subtle yet critical differences between these elements determine which physical metal assets are valuable and worth holding as investments. Understanding the nuances between precious metals and base metals sheds light on the dynamic landscape of gold and silver assets.

What is a base metal?

A base metal refers to various inexpensive metals that are abundant in nature and used in a wide array of everyday applications, such as electricity, wiring, and plumbing. Generally, these metals are more abundant and more affordable to mine than precious metals.

The resulting low economic value prevents base metals from being used as stores of value or investments. Base metals began to be used in circulating coinage only after the adoption of the fiat currency system.

At that point, there was no longer a legal requirement to back currency with, or include, gold or silver. Some of the most common base metals include:

- Aluminum

- Copper

- Iron

- Lead

- Nickel

- Tin

- Zinc

What is a precious metal?

Precious metals are rare, naturally occurring metallic elements distinguished by their economic value. These metals are unique among more common metals due to their relative scarcity, inherent value, and investment merits.

Although most precious metals have practical applications, they’re well known for their use as stores of value. Their limited natural availability in tandem with practical characteristics and historical use in currency lead to higher evaluations than their base counterparts.

Precious metals are available in several physical forms for investment, including bars, coins, and rounds. Some of the most common precious metals include:

Other Types of Metals

Base metals and precious metals are among the most commonly discussed metallic elements in investing. However, other kinds of metals might arise during research.

Alloy Metals

An alloy is created by melting two or more metals together. The purpose of an alloy is to merge the advantages of different metals into a single material. Most modern-day circulating coins feature a metallic combination for improved durability. Even bullion coins contain a small amount of base metal due to the relative softness and malleability of precious metals.

Ferrous Metals

Ferrous metals contain high amounts of iron. Some common examples include cobalt, chromium, and manganese. Due to the general susceptibility and abundance of ferrous metals, they’ve never been used in coinage or as stores of value.

Rare Earth Metals

Despite their name, rare earth metals exist in greater supplies than precious metals. However, investors have been attracted to the steadily increasing demand for these obscure metals in high-tech industries such as electronics and renewable energy. Still, rare earth metals remain a growing and speculative area of investment.

Precious Metals vs Base Metals: Key Differences

Scarcity

Scarcity is a foundational distinction between precious metals and base metals, determining their value (or lack thereof). The impressive rarity of precious metals creates higher tension between supply and demand, resulting in higher prices. On the other hand, the plentiful natural reserves of base metals lead to lower evaluations.

For example, gold and silver have average concentrations of roughly 0.003 and 0.1 parts per million (ppm), meaning that, on average, there are only a few milligrams of these metals in every metric ton of Earth’s crust. Alternatively, nickel and copper have average concentrations of 25 and 40 ppm, respectively.

Inherent Value

Inherent value is another distinguishing characteristic between precious and base metals. While the former group boasts intrinsic worth independent of external factors, the latter’s value is entirely dependent upon utility or demand.

Gold and silver derive their inherent value from their natural scarcity, unique physical characteristics, universal recognition, and millennia-long history as stores of value and means of exchange.

Corrosion Resistance

Although some base metals boast greater tensile strength, they don’t feature the same corrosion resistance as their precious metals cousins. Gold, silver, platinum, and palladium are renowned for their ability to avoid rust or tarnish by withstanding oxidizing agents such as oxygen and moisture. This ability to maintain physical integrity and appearance makes precious metals popular for coinage and jewelry.

Price Growth

Price action is a key indicator of a metal’s investment merit. On this metric, precious metals far outpace base metals. For example, gold prices have recently hit a record high above $3,800/oz, while copper has never reached above $6 per pound!

The overall upward trend of precious metals prices is also indicative of their inherent value, as gold and silver price forecasts for 2025 and beyond indicate further growth on the horizon. Looking back in history, gold outshines the stock market in the 21st century so far, and silver often quietly pulls ahead of the yellow metal.

Investment Merit

The investment merit of precious metals is secured by the combination of inherent value, natural scarcity, corrosion resistance, strong prices, universal recognition, and historical use.

👉 Related Read: Introduction to Investing in Precious Metals

Base metals fall short on nearly all of these metrics, preventing them from being adopted as stores of value and investment vehicles. This distinction is reinforced by precious metals IRAs, which allow investors to put tax-advantaged dollars towards physical gold, silver, platinum, and palladium assets.

Diversify Your Portfolio with Precious Metals

Interested in learning more about diversifying your portfolio with precious metals? Grab a FREE copy of our Precious Metals Investment Guide. It covers everything you need to know about securing your wealth with gold and silver assets.