Replica coins represent a tricky minefield in the precious metals landscape that investors are better off avoiding altogether. These high-quality coins are often indistinguishable from the originals, especially for everyday consumers without the necessary expertise or tools.

Replica coins represent a tricky minefield in the precious metals landscape that investors are better off avoiding altogether. These high-quality coins are often indistinguishable from the originals, especially for everyday consumers without the necessary expertise or tools.

There are horror stories of even seasoned investors losing hundreds, if not thousands, of dollars due to misleading advertisements or simple investment mistakes. The problem is only getting worse as replica coins pour into the physical metals space from domestic and foreign sources.

Understanding what replica coins are, how to identify them, and why they should be avoided is crucial for those looking to make the most of their investments.

Key Takeaways

- Replica coins are made to imitate original coins.

- Some replica coins are used for legitimate reasons, while others are falsely advertised as authentic.

- The number of counterfeit coins is growing due to China’s influence and the rise of online investing.

- Investors can learn how to spot most replica coins, although an expert should be consulted before investing.

- Bullion or numismatic coins tend to be safer and more profitable investments than replica coins.

What are replica coins?

Replica coins are coins designed and minted to resemble an original coin closely. Usually, outward appearance is the only commonality between authentic and replica coins. Everything else, including the precious metal contents, age, mint location, and value, tends to differ drastically. These coins are also called copy coins, reproduction coins, training coins, and imitation coins, highlighting that they aren’t genuine originals.

Replica coins serve various functions. They’re great educational tools for display at schools, exhibitions, or museums without risking theft or damage to the genuine article. History and coin enthusiasts often use affordable coin copies to complete collections when the real deal is too expensive. Unfortunately, some misleading sellers purposefully advertise fake coins as the original to trick investors and collectors into overpaying.

The National Coin Hobby Act—a federal law designed to protect people against deceptive sellers and fake coins—states that replica coins “shall be plainly and permanently marked ‘COPY’.” However, that doesn’t stop China from pumping thousands of counterfeit coins into the US through e-commerce sites. The Anti-Counterfeiting Educational Foundation has witnessed a rise in these counterfeit scams over recent years as online investing increases.

Why Replica Coins Are a Growing Concern

Replica coins fulfill several important roles when their authenticity is clearly marked and fully acknowledged. However, there’s a growing concern among investors and collectors as high-quality forgeries are pushed as originals. Various factors have escalated this issue from a fringe concern to a mainstream threat:

- Technological Advancement: Advanced minting technology has made it cheaper and easier to produce high-quality replica coins that are difficult to detect.

- Foreign Interference: Many countries have lax counterfeit laws, making it easier for foreign actors to produce replica coins abroad and sell them to US investors online.

- Precious Metals Demand: Challenging economic conditions have driven demand for precious metals among everyday investors, resulting in more opportunities for fake sellers.

- Online Investing: The proliferation of banking, investing, and e-commerce sites and apps has made it more important to take steps to avoid scams when buying online.

- Investor Unawareness: Many consumers simply lack the skills to distinguish between authentic and replica coins.

- Sales Tactics: Sellers are increasingly skilled at marketing replica coins with forged certifications of authenticity, official-sounding websites, and fake reviews.

Why are there so many replica coins?

Any business can produce replicas of official US coinage, leading to an abundance of these imitation coins.

The National Coin Hobby Act only requires replica coins to differ in size from the original coin and include the word “copy”…that’s about it.

Despite these safeguards, many people assume they’re looking at a coin with government backing due to its similarity with US Mint coins.

That is simply not true. Only coins minted by the US Mint are legal tender.

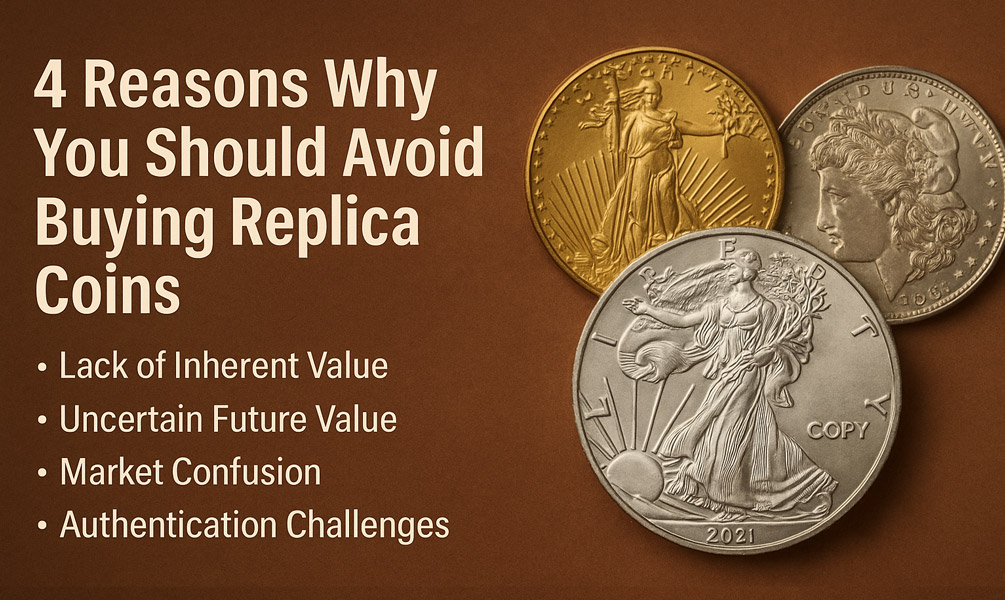

4 Reasons to Avoid Replica Coins

1. Lack of Inherent Value

The cornerstone of investment coins is their precious metal content. The fundamental value of gold, silver, platinum, and palladium imbues bullion and rare coins with their inherent worth. In contrast, replica coins are often made from base metals like copper, zinc, and nickel, which hold little investment value.

Consequently, these replica coins are not recognized as true physical assets like their authentic counterparts. That’s why so many unfortunate cases involving replica coins end with people selling their investments for far less than their initial purchase.

2. Uncertain Future Value

The future value of any asset, including gold and other precious metals, is inherently unpredictable due to fluctuating market factors. While informed predictions can be made based on historical price trends, futures market activity, and other financial indicators, replica coins lack the necessary data to support such forecasts.

The US Mint refrains from commenting on the potential future value of replica coins as collectibles, underscoring their inherent uncertainty and limited investment potential.

3. Market Confusion

Replica coins continue to generate rampant confusion among coin collectors and precious metals investors. This uncertainty is exacerbated by the fact that any private mint can produce these imitation coins. Their striking similarity to authentic US coins leads many people to mistakenly believe the coins are legitimate or backed by the government.

Even if all domestic producers of replica coins follow counterfeit laws, foreign manufacturers can always avoid them. Stricter laws wouldn’t solve the issue, as unfaithful actors always look for ways to scam investors.

4. Authentication Challenges

It’s increasingly difficult to identify replica coins, especially when counterfeit laws are violated. As mentioned, minting technology is advancing exponentially, and sellers have developed clever tactics to entice consumers.

Spotting high-quality replica coins requires a trained eye, specialized equipment, and up-to-date knowledge about counterfeiting tactics–resources most investors don’t possess. This makes it easy for even experienced collectors to be deceived, further increasing the risk of investing in replica coins.

Legitimate Alternatives to Replica Coins

When diversifying with precious metals, investors are better off sticking with numismatic or bullion coins. Both assets are known for their impressive precious metals content, inherent value, and high liquidity. It’s also easier to identify the authenticity of numismatic and bullion coinage, decreasing the opportunity for investors to fall victim to scams.

Talk to a Professional Advisor

The US Mint recommends investors consult professionals before investing to save valuable time and money. At Scottsdale Bullion & Coin, our precious metals advisors are happy to help you determine the authenticity and value of any gold or silver coin. Contact us today by calling toll-free at 1-888-812-9892 or using our live chat function.