There are plenty of helpful guides explaining how to invest in gold, but not much is said about the pitfalls you should avoid. Unfortunately, many first-time gold buyers become disillusioned after a single mistake wastes their time or money and erodes their trust. Understanding (and avoiding) these stumbling blocks can make sure your gold investing journey is set up for success so you can enjoy the long-term advantages of gold investing.

#1 Don’t rush into buying gold.

Savvy investment decisions require time, patience, and due diligence. Too often, investors fall victim to FOMO (fear of missing out) due to bullish news or impressive price jumps. This impulsiveness may lead to overpaying for gold products or investing in assets that don’t match your goals. Investing in physical gold has never been a get-rich-quick-scheme.

#2 Don’t buy gold before knowing all your options.

There’s a common misconception that gold is a singular asset. In reality, investors can choose from a wide range of gold assets including gold bullion bars and coins, investment grade gold coins, and gold stocks. Every asset type comes with unique benefits and considerations, so don’t settle for just one type of gold.

#3 Don’t buy physical gold to capture short-term price movements.

Physical gold performs best when held for extended periods. There are price jumps in the short term, but you shouldn’t try to capture these movements. The process of buying and selling physical gold is slower than trading stocks and ETFs digitally.

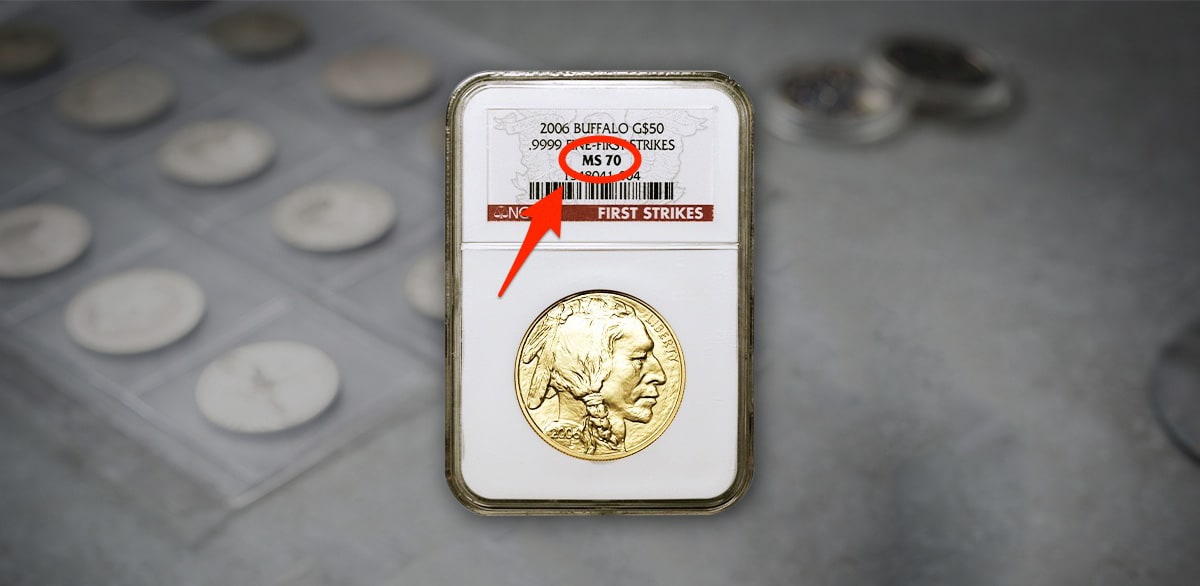

#4 Don’t buy gold based on coin grades alone.

Coin grading is a popular way to objectively assess a coin’s condition. However, some new investors mistakenly correlate a high grade with a high value. While a graded coin may be a good investment, you should never buy gold coins for their grade alone. This would ignore other relevant factors that determine a coin’s overall value.

Do: Assess a coin’s value based on all relevant factors including purity, weight, grade, rarity, history, population, demand, and numismatic value. Keep in mind that the type of coin can influence what factors are considered relevant when evaluating price. Consulting with a reliable coin dealer can put you on the right track.

#5 Don’t buy “dealer exclusive” or modern-graded bullion coins without research.

Some dealers place unreasonable premiums on so-called “dealer exclusive” coins in an attempt to overcharge unassuming investors. Despite the fancy-sounding name, there’s nothing inherently valuable about these coins. Many are simply worth their weight in gold or silver, just like other bullion coins. Be on the lookout for a similar pitfall with modern-graded bullion coins. Sometimes, coins with impressive grades are sold well beyond their value by sellers hoping investors conflate high grading with high value. Don’t fall prey to these shotty sales tactics.

#6 Don’t ignore the value of a physical gold IRA.

Contrary to popular belief, the IRS allows investors to hold physical gold in a tax-deferred retirement plan. This specialized retirement account, known as a self-directed gold IRA, allows adding to your retirement nest egg with tangible gold assets and all the associated benefits. Nobody investing in gold should bypass this invaluable investment option without giving it serious consideration.

Everything you need to know to get started in Precious Metals

Learn how precious metals can strengthen your portfolio, protect your assets and leverage inflation.

Request the Free Guide#7 Don’t use leverage.

Investing in gold is exciting which leads some first-time investors to look for shortcuts to buy more in a shorter period. One of the most common (and least recommended) methods is using leverage. This is where investors borrow capital to increase their holdings with the hope of getting a higher return. More often than not, this overextension can leave investors with larger losses instead of greater gains.

#8 Don’t rely on paper gold in place of physical gold.

Another common misjudgment among new investors is ignoring the key differences between paper gold and physical gold. Paper gold in the form of gold ETFs, mutual funds, and mining stocks, only gives you indirect access to gold while still exposing you to the downfalls of traditional markets. Gold is typically easier to accumulate in its paper form, but that doesn’t mean it’s a smart investment.

#9 Don’t fall for “FREE GOLD” offers.

There’s a myth of free gold and silver circulating in the precious metals investing space which is just that: a myth! Some precious metals dealers rely on the allure of “free” coins, bars, or bullion to capture unwitting investors. In reality, these clever sellers simply shift the cost of the “gift” to other expenses such as the dealer premium. No matter what’s promised, investors invariably end up paying full price.

#10 Don’t Buy Gold Coins on TV.

(this is not a real offer.)

A lot of people first consider buying gold after seeing a convincing advertisement on TV. Although these enthusiastic sellers make quite the pitch, don’t assume what they’re selling is a good buy. Gold coins sold through TV tend to have inflated prices and might not even have full precious metal content. Some official-looking coins might turn out to be gold-plated commemorative coins.

#11 Don’t buy gold coins from online marketplaces.

In a world of next-day deliveries, some investors are captivated by the convenience of buying gold online. Although Amazon, eBay, and even Craigslist have a wide selection of gold coins, these virtual marketplaces are minefields of potential fraud and scams. Even experienced investors steer clear of these e-commerce sites due to the presence of sophisticated counterfeits and a lack of regulatory oversight.

#12 Don’t buy gold from an inexperienced advisor.

While it’s always advisable to work with an experienced advisor, it’s especially critical when you’re new to investing in gold. An inexperienced investor might recommend the wrong kinds of assets or encourage you to make purchases at inopportune times. You don’t want to entrust any amount of your hard-earned dollars to green advisors.

#13 Buying gold coins sight unseen.

There’s a natural draw to the sight-unseen market as these coins tend to go for lower-than-average prices. However, you shouldn’t put faith in what you can’t see. Cheaper isn’t always better in the gold market. To make matters worse, you might not even know you’ve been fleeced until you try to resell the coin only to realize the value is less than you thought.

Make Your First Gold Investment a Success

Don’t betray the decades of hard work you’ve invested in building your retirement savings. Take the time to ensure your gold investments fall in line with your specific needs and goals by requesting our Free Precious Metals Investment Guide.