With spot gold prices sitting near all-time highs following a confident surge, many investors wonder if now is the time to sell their holdings. Watch this week’s The Gold Spot to hear Scottsdale Bullion & Coin Sr. Precious Metals Advisor Steve Rand and Precious Metals Advisor John Karow explain why now is the time precious metals investors should BUY instead of sell, what the economic forecast looks like, and why gold is still an effective hedge against market shocks.

Low Precious Metals Premiums = Buying Opportunity

Although gold prices recently hit a record high, premiums on precious metals are still advantageously low. These add-on costs, which cover the overhead accrued by precious metals dealers, are reliable indicators of buying opportunities.

“Premiums are low, they're tighter than they have been in quite a while. That’s a signal to buy, not to sell.”

On top of that, several broader market indicators point to further growth for gold and silver prices.

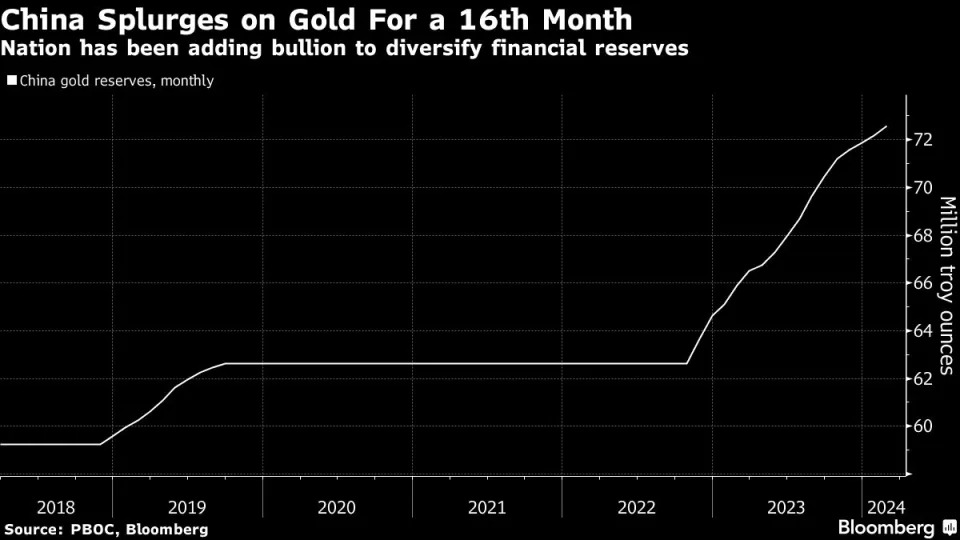

Central Bank’s Surge Gold

This strategy advice is supported by the actions of governments as central banks buy record amounts of gold. China continues to lead the pack, marking its 16th consecutive month of gold bingeing, with 12 tonnes added last month. Overall, central banks have been buying gold at a record rate of over 1,000 tonnes per year, underscoring the global shift into physical precious metals.

Geopolitical Tensions Mount

The deteriorating geopolitical climate is further encouraging this transition to gold. Wars rage in Eastern Europe and the Middle East, China flexes its military might in the South China Sea, and the BRICS nations threaten to destabilize the dollar with a BRICS currency. Gold prices have already responded to these developments by hitting record highs, but worsening conditions indicate prices aren’t stopping at these levels.

Interest Rate Cuts Incoming

The Federal Reserve predicted three rate cuts throughout 2024, early in the year. Those odds have only improved since that initial forecast. These interest rate reversals are bullish for gold prices, adding more fuel to the yellow metal’s upward momentum.

Gold Prices Too High?

It’s perfectly rational for investors to consider selling after an asset breaks through into uncharted territory. However, when the fundamentals undergirding the asset’s value remain strong, there’s good reason to believe spot prices will continue moving upward. This is precisely what’s happening with spot gold prices.

After notching record numbers, gold prices maintain their stability, signaling the potential for more upward movement. This is reminiscent of the 1980s when gold skyrocketed to $850 amid soaring domestic inflation and geopolitical turmoil spurred by the Iranian hostage crisis and the Russian invasion of Afghanistan.

The economic and geopolitical landscapes share many of the same features. A recent study found that gold prices would have to reach $3,000/oz today after adjusting for inflation to match the high of the 1980s. That represents a roughly 38% jump from current evaluations. The combination of market volatility and global uncertainty means there’s still plenty of runway for gold prices to move even following recent highs.

Don’t Wait to Buy Gold & Silver, Buy Gold & Silver and Wait

Everything suggests that NOW is a prime time to buy physical gold and silver. Premiums are surprisingly low given high demand; central banks, institutional money, and retail investors are diving into gold; geopolitical uncertainty is peaking; and economic instability is rampant. Gold price forecasts indicate prices are likely to go higher.

Whether exposing yourself to gold and silver for the first time or adding to your stockpiles, now is a great time to buy. You’re always better off buying and waiting rather than waiting to buy. Pressure is building, and it’s only a matter of time before prices continue to move higher. Selling now would only put you at a disadvantage.

Understand which precious metals meet your needs by requesting our FREE Precious Metals Investment Guide.

Question or Comments?

If you have any questions about today’s topics or want to see us discuss something specific in a future The Gold Spot episode, please add them here.

Comment

Questions or Comments?

"*" indicates required fields