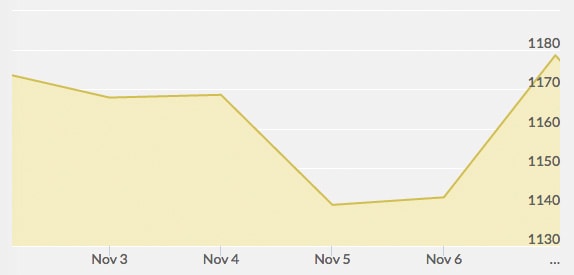

Open: $1,165.00 Close: $1,175.10 | High: $1,175.10 Low: $1,133.70

The price of gold opened the week with a four-year low on sluggish demand for the precious metal in China. This is usually the prime time for Chinese traders looking to buy gold, as buyers stock up on gold ahead of the Lunar New Year holiday. However, the lack of gold-buying may indicate that Chinese traders anticipate the price of gold falling even further. The dollar also rallied to a five-year high on Monday.

The four-year low continued through the middle of the week. Seven of 19 mining companies on Tuesday reported that the interday price point of $1,137.10 per ounce was not enough to cover production costs, according to Bloomberg Intelligence. Crude oil prices also hit a three-year low on Tuesday.

By Wednesday, the yellow metal had lost around $100 per ounce over a week to settle below $1,150—a four-and-a-half year low. Speculators think this may mean gold could drop to below $1,000 in the short term. The monthly meeting of the European Central Bank on Thursday had some investors wondering whether the bank would increase economic stimulus programs, but they revealed no changes. The meeting had no effect on gold prices.

Despite the losses incurred early in the week, gold actually made a recovery to close out the week $10 higher than when it began. Friday’s October employment report from the Labor Department was considered by some to be the most important economic data point of the month for gold. Indeed, the numbers showed that U.S. employers added fewer jobs this month than forecast last month. In response, gold trading was enthusiastic and hit more than double the 100-day average, according to Bloomberg. The dollar also headed toward a three-week low. The jobs data could be an indication that the Federal Reserve will hold out on raising interest rates too soon, which is a positive indicator for gold.