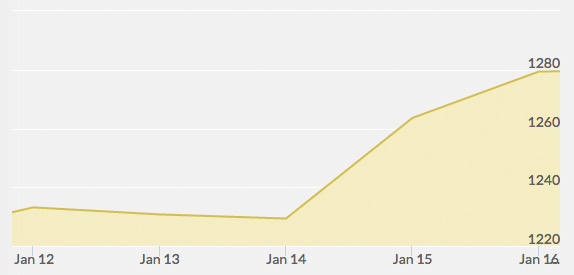

Open: $1,230.90 Close: $1,275.80 | High: $1,275.80 Low: $1,227.60

Gold started out this week on a weak note but quickly revved up to reap overall gains. Tuesday was a turbulent day in the marketplace as speculators worried that Greece might soon abandon the euro. This increased gold’s appeal as a hedge fund, and gold futures hit a 12-week high at $1,243.60, the highest point since October. In response to concerns of global economic crisis, investors flocked to the Japanese yen, U.S. and German bonds and, of course, buying gold.

Higher European stocks and a resilient dollar quickly tempered the gain later in the day, but the steady gains continued into Wednesday. Even with a stronger dollar, gold did not retreat—a very strong sign for the yellow metal. Mitsubishi analyst Jonathon Butler said, “The fact that gold can rally despite the dollar being relatively strong says something of the uncertainty regarding the U.S. economy.”

Wednesday showed continued market volatility, a bullish factor for gold. The World Bank cut its economic growth forecast for 2015 and 2016. The Japanese yen rose by 1% against the U.S. dollar. Physical gold buying remains solid. Analyst Suki Cooper at Barclays stated that, “…demand emanating from India and China remains relatively healthy and should offer a better floor for prices.”

Gold prices remained steady through Thursday and responded positively to U.S. economic data that was released on Friday. U.S. consumer prices were reported to have fallen the most in six years. This translates to general sentiment that the Federal Reserve will be more conservative about raising interest rates, which is positive for gold. The Swiss government also did away with a cap on the franc on Friday, indicating inflation is on its way, and investors flocked to gold as a safe haven asset, posting the highest gains in four months to close at $1,275.80. Some analysts predict $1,300 is just around the corner.