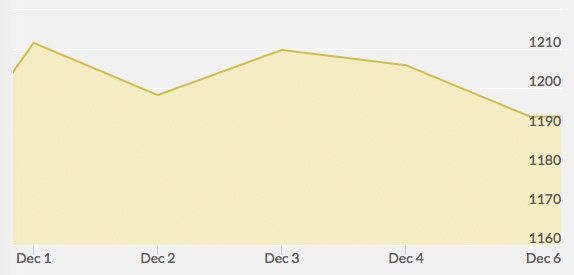

Open: $1,212.00 Close: $1,190.50 | High: $1,220.00 Low: $1,190.50

Gold opened the week on the largest daily surge in a year, gaining such momentum due to the spike in oil prices, weak U.S. dollar, technical buying, Indian buying and even safe haven demand. The first day of the trading month started out strong. Monday hit a five-week high, even after the verdict from the Swiss vote was released. The Swiss vote to require the government to hold 20% of its wealth in gold did not pass on Sunday, but the vote had little effect on the market. Monday prices dipped slightly later in the day, but the vote caused no significant waves in gold trading.

By Tuesday’s end, gold prices had given back about half of their gains on a stronger dollar and lower oil. The European Central Bank held a meeting on Thursday; so, gold prices rose slightly on Wednesday in anticipation of possible monetary stimulus measures. Also, the U.S. dollar climbed to the highest point in 5 ½ years on Wednesday; optimism about the U.S. economy abounds.

Gold suffered some losses on Thursday after the ECB meeting revealed that the bank would reevaluate monetary stimulus next year, but would not enact any money printing now. The euro rebounded from a 28-month low after the news. The market was also waiting on U.S. non-farm payrolls reports on Friday. Once the report was released, the dollar climbed to its highest level since 2009, thereby causing gold to drop to the lowest price point of the week. However, gold did not plummet as far as some may have expected after the U.S. jobs data came back much stronger than expected.