Gold market analysts largely focused on the dollar’s performance during the last full week of July. The good news for gold was that the greenback fell for most of the week—despite strong economic data that would support at least two more Fed interest rate hikes in 2018. Maybe the markets are finally feeling jitters as the economy hurtles toward the longest economic expansion ever and the trade war threatens to make its inevitable crash even worse.

Besides the dollar and geo-economic risk, what are gold’s other traditional price movers? Read “How These 10 Factors Regularly Influence Gold Prices” to find out.

Gold Price Movement Indicators

Monday, July 23, 2018

Dollar Rebound

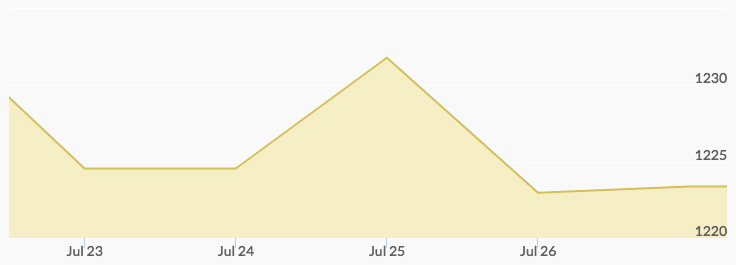

Following a Tweet on Friday from President Trump expressing disapproval of Chinese and European Union currency manipulation, the Fed’s policy of raising interest rates, and the dollar’s continued strengthening, the greenback fell and remained low on Monday.[1] The softer dollar made gold less expensive to investors using foreign currencies. Gold buyers in other countries took advantage of the opportunity, pushing the spot price of gold to $1,235.10 in early trading, the highest it’s been since July 17.[2]

However, throughout the day, the dollar resumed its rise, holding steady against the yuan and the rupee—currencies of some of the world’s leading gold buyers. The yellow metal felt the pressure: by 11 pm, the price of gold hit the daily low of $1,222.60.

Experts don’t expect the dollar to stay strong much longer though. ‘We’re seeing a bid in the dollar that’s driving the gold low today, but we do think the dollar is set to weaken going forward, so we do see gold trading higher on the near term, two to three months outlook,’ asserted commodities strategist at TD Securities, Daniel Ghali.

A Reuters poll of banks and brokerages on Monday indicated respondents expect gold prices to reach $1,300 an ounce in 2018. Read what other experts are saying in our “Gold Price Forecast 2018.”

Tuesday, July 24, 2018

Dollar Retreat

The trajectory of gold prices on Tuesday closely traced that of the dollar. Market expectations of further Fed interest rate hikes sent U.S. Treasury yields to their highest level in five weeks and the dollar index up to 94.641 in the morning. Around 1 am gold prices dipped to $1,218.60.[3] However, as the day progressed, the focus shifted to the much-anticipated U.S. GDP data due out on Friday. While analysts expected strong second-quarter growth above 4.1 percent, the possibility of a different outcome brought a small spike in safe haven demand. The price of gold climbed to a high of $1,228 from 10 am to 11 am, and the dollar dropped .2 percent.[4]

Wednesday, July 25, 2018

Dollar Retreat

Wednesday brought more dollar drops: the ICE U.S. Dollar Index, which measures the greenback against a basket of six rival currencies, fell .1 percent to 94.49. Commodities priced in dollar, such as gold and silver, climbed higher as they became less expensive for foreign buyers. The price of gold rose from the low of $1,223.70 at 1 am to the high of $1,232.90 from 9 pm to 10 pm—a nearly $10-dollar jump. New York’s SPDR Gold Trust, the largest gold-backed, exchange-traded fund, was up over 1 percent since July 18, reflecting increased interest in gold from investors.[5] How much more could the dollar weaken? Read “When Will the Dollar Crash?”

Experts pointed to the Fed’s interest rate raising policy as a temporary hinderance to gold’s performance. ‘In the short term, upside should be limited as headwinds from the U.S. rate cycle persist. … With the dollar expected to eventually roll over and upside pressure to U.S. bond yields easing, medium- to longer-term buying opportunities should open up,’ explained analysts with Julius Baer. ICBC Standard Bank strategists predicted gold to average $1,260 in the third quarter and $1,300 in the fourth.

Thursday, July 26, 2018

Decreasing Geo-Economic Risk

The appearance of a resolution of the U.S. trade conflict with the European Union following a meeting between President Trump and the chief of the European Commission, Jean-Claude Juncker, on Wednesday whetted traders’ appetite for risk on Thursday. During the meeting, both leaders agreed to work toward eliminating tariffs on non-auto industrial goods, to lower barriers, and to ramp up the trading of chemicals, medical products, services, soybeans, and pharmaceuticals. Gold prices, often purchased as a hedge against economic risk, reversed their course from the previous day, pulling back from the high of $1,231.20 at 1 pm to the low of $1,222.30 at 5 pm.[6]

Analysts were critical of President Trump and Juncker’s lack of specific details as to how they would follow through on their promises, indicating there “is ‘massive uncertainty’ as to what Wednesday’s deal means” and calling “the deal ‘vague.’” They were also quick to point out that the agreement would not ameliorate the trade issues with China. ‘We do not believe that recent positive developments regarding U.S.-EU trade should be interpreted as a reduction in risk in the other major trade dispute, with China. In fact, they likely mean the opposite,’ asserted Goldman Sachs.

Friday, July 27, 2018

Strong U.S. Economic Data

Market reactions to strong U.S. economic growth on Friday were mixed. In the second quarter of 2018, the economy accelerated at the fastest rate in nearly 4 years, with government and consumer spending fueling a 4.1 percent expansion of gross domestic product.[7]

Despite supporting two more Fed rate hikes this year, the data failed to send the dollar and treasury yields higher. Both slipped, as gold prices ascended from the low of $1,217.60 at 6:40 am to the high of $1,226.10 at noon. ‘Dollar weakness looks like it will continue and gold will see some short-term support,’ noted Walter Pehowich, the executive vice president of investment services at Dillion Gage.

Lingering investor concerns over trade tensions with the E.U. and mounting expert predictions of an economic crash may have diminished the markets’ risk appetite.

Where are gold prices today? Check our Gold Spot Price Chart.