Price is what you pay – value is what you get.–Warren Buffet

Money is an emotional topic. And the more money at stake, the stronger the emotions become. Thanks to Quantitative Easing (QE) and the Federal Reserve/Central Banks worldwide, making money in stocks, real estate and bonds has been like “shooting fish in a barrel”. Even when the markets crashed a dozen years ago, anyone who rode out the rollercoaster ride made their money back, and then some, years later. So, it’s easy to understand why greed, ignorance and overconfidence are the emotions du jour.

However, history points out time and time again that bull markets inevitably end, and in the case of bubbles, they end badly. Business cycles, like birth and death, and the sun rising and setting, are just part of the natural order. Of course, markets ultimately turn for a reason, but in the “heat of the battle”, it is human nature not to see the forest through the trees. Despite a 28 trillion-dollar deficit that can never be paid back and trillions upon trillions of dollars being printed out of thin air, greed and lack of common sense continue to prevail as all 401K’s ride their way to the stars.

Last week I talked to a gentleman (who had “concerns” and was inquiring about gold and silver) and I asked him if the recent 1.9 trillion stimulus package and proposed 2.3 trillion-dollar infrastructure package (on top of the already massive debt in place) was of one of his concerns. I also asked him if he was considering physical gold and silver as insurance. As a way of protecting his wealth. His response was, “I’d have to be crazy to get out of any stocks right now.”

When I suggested he consider holding 10-20% of his assets in physical gold/silver to hedge his remaining large stock position, he said that made sense, but not now. So, here is a good example of someone who’s instincts have him taking a look, but he simply wouldn’t pull the plug. Maybe due to greed. Or maybe his spouse or financial advisor are not supportive. I don’t know, but I do know that measured by normal historical standards, the risk in owning stocks and bonds has never been greater. And, based on all the money being printed AND the extremely bullish fundamentals of tight supply and strong demand, the risk in owning physical gold and silver has never been less.

Andy Schectman of Miles Franklin was interviewed last week and emphasized that because of the massive printing in place, to be solely in dollars is a colossal mistake. The question Andy puts out to everyone is, “What amount of wealth do you want to leave in a currency that is being destroyed before our eyes”? Andy also points out that, “Big money, in the form of Central Banks and wealthy family offices worldwide, is de-dollarizing and buying metal. They are front running the evisceration of the US Dollar”.

Mike Savage of Raymond James confirmed this observation by saying, “As the central banks and major banks play their games and manipulate market prices, they also have been hoarding physical gold and silver for their own accounts. It was just announced that Russia is further divesting from the US dollar and buying gold with the proceeds. Many other central banks, including Russia, also have been buying gold at an astounding pace. (2,200 tons in the last three years).” But, let’s face it, the government does not have YOUR back. For those still on the sidelines, maybe it’s time for you to act as your own Central Bank and protect yourselves accordingly?

As the saying goes, in respect to owning insurance, “Better a year early then a day late”. And never has this truth been more relevant given the money printing lunacy and the ability of markets worldwide to now turn on a dime.

In 2007/2008, many individuals and businesses were wiped out as the market crash seemed to “come out of nowhere.” Last March, the stock market fell 40% in a matter of weeks, again seemingly “out of the blue”. Of course, the Fed came to the rescue both times, but what if the next time around, the Fed is no longer able to “kick the can down the road?” What if the debt has gotten just too large? What if all the free money results in the ultimate destruction of the US currency?

The public majority is not prepared. Even the majority of those who instinctively know something is wrong, have not taken action. Although premiums for physical gold and silver are relatively high, the sector as a whole is extremely undervalued. Conversely, stocks and bonds are extremely overvalued, and besides living on borrowed money, are also living on borrowed time. At a time when the bullish public sentiment for gold and silver is very low, legendary gold investor Jim Sinclair of JSMineset.com has the following to say, “Gold and silver are headed to new highs breaking out soon. Gold and silver will run for at least five years.”

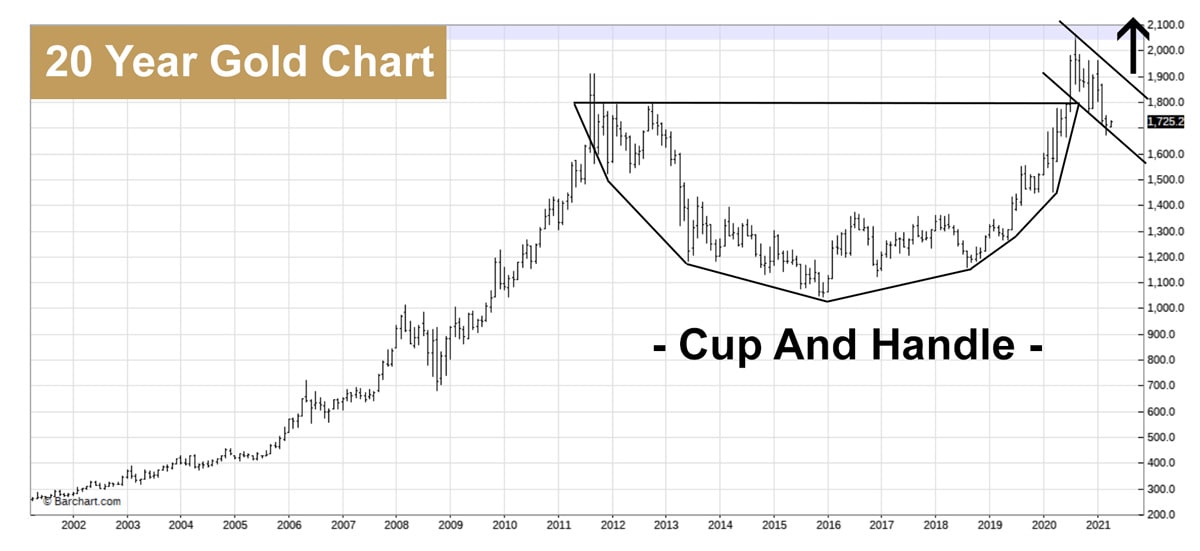

Supporting higher gold and silver prices are the long-term charts posted below. Especially the 20-year gold chart, in which the “cup and handle” formation is EXTREMELY bullish, and projects a level of $3,000oz in the near future. The next stop for silver, over the same time period, should be in the range of $50 – $60oz.