Ask an economist why the price of gold goes up or down and he will invariably tell you that it is merely a function of the law of supply and demand. If more people want gold and fewer people want to sell gold, the price goes up. If there are more willing sellers than buyers, the price of the precious metal will decline.

It also follows that those who own the most gold have the greatest power to influence its price. The largest owners of gold are countries and their central banks. When the United States, China, India, or Russia decides to become a net-buyer or net-seller of gold, it has a far-reaching impact on gold prices.

The World Official Gold Holdings report, presented by the World Gold Council (WGC) in November of 2014, indicated that the combined gold reserves of all of the countries in the world totaled 32,056.5 tonnes. This number represents the physical gold held by central banks in their respective countries. As of the end of 2013, the WGC reported that the official amount of gold known to exist above ground was 177,200 tonnes. That means that central banks hold around 18% of all the gold that exists above ground.

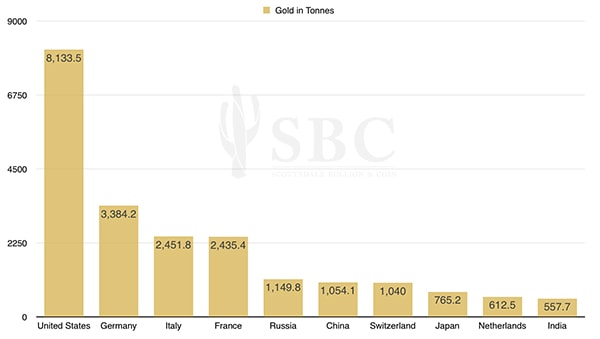

Countries with the Largest Gold Reserves (Tonnes)

United States (8,133.5), Germany (3,384.2), Italy (2451.8), France (2,435.4), Russia (1,149.8), China (1,054.1), Switzerland (1,040.0), Japan (765.2), Netherlands (612.5), India (557.7)

* The IMF is not a country but is the holder of the world’s 3rd largest reserves at 2,814.0 tonnes

United States

As the United States is the world leader in gold reserves, it can certainly influence the price of gold. In 2013, the U.S. sold 1,280 tonnes of the precious metal to buyers around the world. Adding supply to the world gold market has the effect of suppressing, or driving down, gold prices.

Russia

When Putin decided to seize Crimea and then continue to contribute to the chaos in Ukraine, the United States and many other countries placed sanctions on Russia. Russia’s economy has been hurt and the response has been to purchase gold. In addition to purchasing gold on the world market, Russia is also buying the gold mined in its country because miners cannot sell it to other countries due to the sanctions. Putin may have other non-publicized reasons for accelerating his gold-purchasing program from 77.5 tonnes in 2013 to 115 tonnes up to this point in 2014. When Russia’s central bank increases its reserves, it has the effect of driving up the price of gold.

China

Officially, China only has about 1/8 as much as the United States’ gold reserves. Unofficially, that number could be much higher. China is not transparent about its gold holdings and many suspect that the country is holding significantly more physical gold than is officially reported. Estimates by the WGC are that China imported 1,132 tonnes of gold in the past year. China has also been buying gold mines around the world and channeling the yield from those mines back to the homeland. China has the money to acquire as much gold as they want and is definitely capable of moving gold prices in a big way.

Switzerland

On the last week of November, Swiss voters will go to the polls and decide if their currency, the Swiss Franc, should be backed by gold. If the vote is affirmative, the Swiss government will have to purchase approximately 1,500 tonnes of gold over the next five years to back their fiat currency with gold. Such a move would have widespread implications. Other countries that would like to strengthen their currency may follow suit and start buying physical gold by the tonne. If such a scenario plays out, expect the price of gold to soar.