“I wouldn’t expect any resolution out of this, if we get one, for a handful of years…”– Damian White, Sr. Precious Metals Advisor

These catastrophic failures are eerily reminiscent of the Lehman Brothers collapse, which ushered in the housing market crash of 2008. Although the circumstances vary slightly, the extent of damage fallout could leave a similar, if not worse, scar on the US economy.

Watch this Gold Spot Special Alert to hear Scottsdale Bullion & Coin Founder Eric Sepanek and Sr. Precious Metals Advisor Damian White shed some light on the SVB saga, where this leaves the banking system, and how investors can stay safe amid economic turmoil.

What Happened to SVB?

A few days ago, Silicon Valley Bank (SVB) was a highly regarded banking institution as the 16th largest in the US. Its precipitous downfall has now put the entire US banking system on edge.

SVB was primarily a commercial bank that provided significant funding for tech startups in the Silicon Valley area. Early on, the bank enjoyed an astronomical influx of cash as tech businesses overflowed with funding.

As the economy reached new lows in 2022, those funding spigots were virtually switched off, forcing companies banking with SVB to burn through cash reserves. The crux of the issue lies with SVB asset managers who placed short-duration client cash into long-duration government bonds. Eventually, the bank had to sell these bonds at the bottom of the market to keep up with customer demand for money, essentially resulting in a total collapse.

The Systemic Problem Infecting Banks

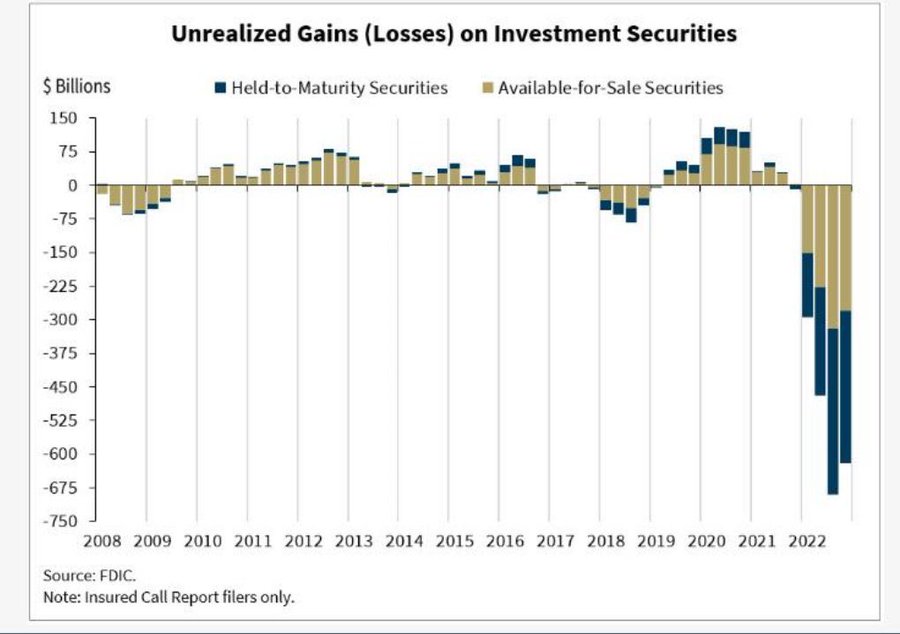

The SVB drama isn’t a stand-alone incident. Instead, it could be just the opening act of a long, nightmarish saga. Tragically, the fundamental issue of diluted bonds is a systemic problem across the banking system. Nearly all major banks have massive bond losses on their balance sheets. SVB might dominate headlines, but it’s neither the first nor last bank to fail for these reasons. In fact, more than 20 banks are on a list of potential failures.

The Contagion Eyes the Federal Reserve

The viral spread of bond losses sparking banking shutouts is coming across the market. If you thought SVB’s burnout was problematic, consider the impact of a fallout from the largest holder of government bonds: the Federal Reserve. The Fed currently holds well over a trillion dollars in unrealized losses and suffers from the same balance sheet issues as all these banks going belly up.

Biden’s Solution is More Spending

Before its doors could open last Friday, the government took receivership of it. In typical Biden fashion, the proposed solution to this singular economic threat is more spending. The FDIC only has $125 billion in reserve funds which pale in comparison to the $10 trillion Americans store in banks. This betrays the notion that the government can solve this problem simply by flipping on the money printer. The monetary system is beyond saving with the government’s resources, so the administration is merely clamoring to save confidence. The Fed is stuck having to raise interest rates ad nauseam to curb inflation while causing a national banking crisis at the same time. It’s a lose-lose situation with the American people left holding the bag, once again.

Americans Withdraw in Favor of Hard Assets

“People are pulling cash out. What are they doing with that? They’re buying hard assets; they’re buying gold. I saw it all day yesterday; it was crazy.”– Damian White, Sr. Precious Metals Advisor

The rush to withdraw cash from a faltering banking system is only half the story. The other noteworthy half is where that cash is being placed. Right now, there’s a unanimous swap from digital bank accounts to hard assets as investors eagerly seek protection from economic pressures. Gold and silver prices shot up following SVB’s highly publicized debacle before stabilizing today. If 2008 is any indicator, gold and silver prices take a while to react to market-wide meltdowns. However, when it happens, prices skyrocket with no intention of returning to previous levels.

Buy Gold and Wait, Don’t Wait to Buy Gold

There’s no telling when gold and silver prices will skyrocket again, in response to all the economic turmoil that’s been brewing for the past few years. It’s only inevitable that this reaction is incoming. Predictions for a strong 2023 for gold suggest it’s approaching. As always, it’s best to buy gold now and wait instead of waiting to buy gold and silver.

Please feel free to contact us today if you have any questions about this ongoing debacle. Our knowledgeable Precious Metals Advisors would be happy to further explain the situation and help you determine if gold and silver investments are suitable for your goals.