2016 has proven to be not just a bad year for the stock market thus far, but one of the very worst years on record. In two hundred years of public trades, no one week has opened up a year as poorly as the beginning of 2016. At times when markets seem shaky, it’s typical for gold to come to the rescue for investors interested in hedges against economic downturns. While it’s not clear whether 2016 will continue on a downward slope, many retail investors believe that gold represents a great investment vehicle after several years of lost value.

Early Gains for Gold

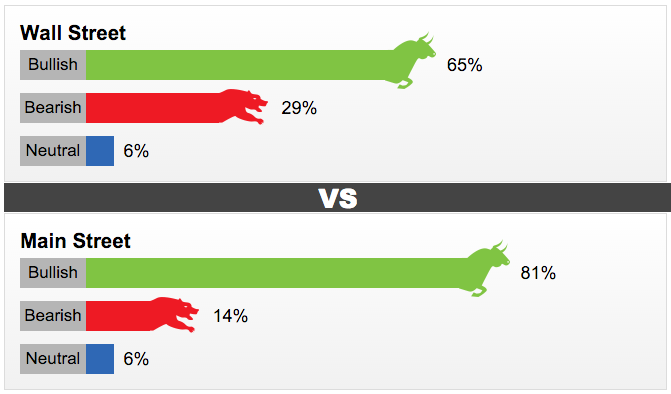

No commodity has performed better in the first month of 2016 than gold. As oil prices continues a downward slide—you may notice gas is as low as $1.50 per gallon, the first time in nearly a decade and a half—the future of energy appears significantly more risky than many investors are willing to face. Gold, by contrast, appears to be just about risk-free. A survey published by Kitco News revealed that no less than 82% of retail investors claim that they are bullish on gold, believing the 2016 rally to hold through as the precious metal climbs in value and recovers the losses it suffered in 2015. Of those who participated in the survey, just 14% claimed to be bearish on gold, while only six percent claimed to be neutral on the precious metal. Most of the experts surveyed, including investment bankers as well as bullion dealers and futures traders, expect to see higher gold prices within the next month of trading as well.

Recovery Outlook for Gold

There’s reason to be hopeful: gold has climbed above the all-important $1100 per ounce figure without dipping back down, suggesting that the gold bubble is no short-term fix but rather a first step towards a golden recovery. Gold mining companies, who have a far greater interest in the price of gold than any individual investor, have begun to follow suit in ways that look like they are preparing for an uptick. After shucking hundreds of jobs in 2015 and writing down no less than three billion dollars of assets, Barrick Gold has come out ahead on the market, with their stock prices rising by 20% through the month of January. Since the NYSE ARCA Gold Bugs Index closely follows the Comex gold close price, with both peaking in 2012 and dropping ever since, the good news for gold investors is twice as nice.