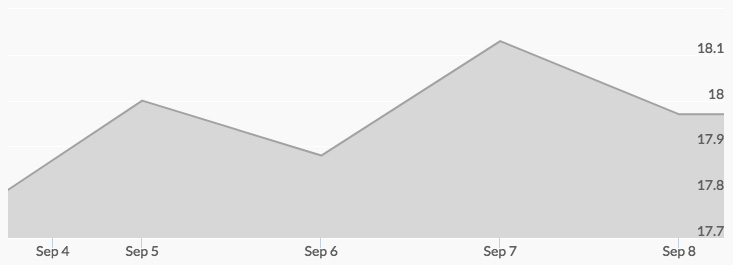

Last week’s activity in the silver market suggests significant buying will bolster prices. After an opening quote of $17.84 on Monday, silver buying during the day resulted in a close of $17.88. Aftermarket activity brought a Tuesday opening price of silver of $17.95. What seemed to be psychological resistance kept the price fluctuating with light volume around the $18 barrier before closing at $17.92. That important mark came into play again on Wednesday when the markets opened at $17.96, moved to $17.98, and then pulled back to close at $17.85. After opening two cents above the $18.00 mark on Thursday, live silver prices moved to close at $18.10. Silver prices opened at $18.06 on Friday morning and closed at $17.97, a gain of $.13 for the week.

Silver prices are now at five-month highs and are positioned to produce further gains based on activity in futures markets. 1 Any additional decline in the U.S. dollar, along with the ultimate impact of the two major hurricanes, will play a role in keeping a bullish direction in next week’s trading.

Central banks will continue to affect the markets in the coming two weeks as the comments from the ECB are parsed, Swiss National Bank and the Bank of England hold their monetary policy meetings, and the U.S. FOMC policy statement is released.

Another important indicator for the U.S. economy comes out on Thursday in the form of the latest U.S. CPI data. 2 If the CPI report again comes in low it will indicate the Fed needs to delay interest rate increases. On the other hand, if it gets back on target the committee members would have more confidence in raising rates in the next month or two. One additional indicator will come out early Friday when U.S. retail sales data is reported.