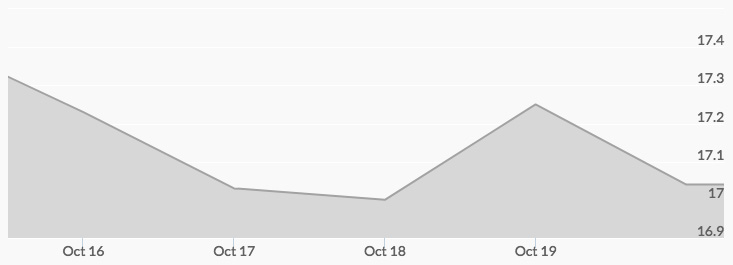

Silver prices opened last week at $17.42, and after briefly rising by $0.03, slipped to $17.21 by the end of Monday’s trading. A review of the historic silver price chart indicates that this trend continued into Tuesday as the market opened at $17.14 and ended the day at $17.07. Wednesday opened with the price of silver at $17.00, and then after flirting with a high of $17.01, closed the day at $16.95. Like gold, Thursday’s market opened significantly higher at $17.05 and surged all the way to $17.27 in intraday trading before settling at $17.18 at the close. However, Friday’s open slid to $17.10 and while the day saw a high of $17.19, Friday’s close pulled back to $17.03.

Several market factors influenced silver’s price trajectory last week, which closely mirrored that of gold. The pullback in the first few days of the week was tied to the dollar’s strength, which was generally attributed to the prospects for a deal on President Trump’s tax reform bill, the likelihood of an established candidate as the next Fed Chair, and the relative quiet in the escalation of tensions with North Korea. Thursday’s strength in silver prices showed that sanity had returned to the market, but the Senate vote to approve a budget plan paving the way for tax cuts late Thursday placed some pressure on the precious metals market on Friday. 1

While many analysts remain bullish on precious metals to close out the year, some technical analysts are particularly interested in silver. Essentially, the view is that while both gold and silver are building a base of support for a major bull move in the coming month, the upward pressure is particularly strong in silver. Certainly, with both geopolitical uncertainty and the possibility of an uptrend in economic growth, the argument can be made that silver, with all its industrial applications, is in an especially unique position to prosper. 2