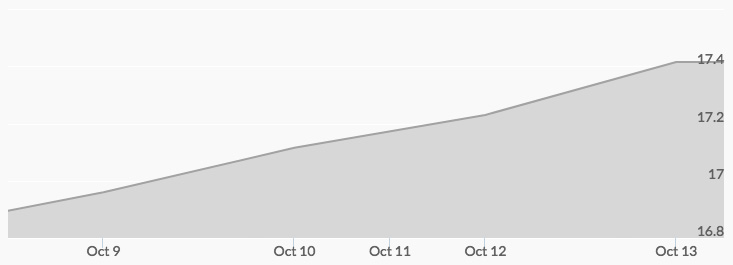

Solid interest with steady buying resulted in a strong week for silver after opening Monday at an initial quote of $16.93. Silver prices teased the psychologically important $17 barrier by midafternoon before closing at $16.96. However, the aftermarkets produced sufficient new buying to bring a Tuesday opening with live silver prices at $17.17. A daily high of $17.23 quickly followed before profit taking moved the final trade of the day back to $17.14. That was the opening price on Wednesday, before more buying produced a close just a few cents off at $17.19. Thursday’s open was back at the $17.14 mark, but solid momentum took the closing price of silver to $17.25. More buying showed up at the Friday opening with a trade matched at $17.35. With only modest selling, the price for an ounce of silver closed the day at $17.42, up 49 cents for the week.

The movement last week shows that the overall trend for silver remains bullish. Securities & Exchange Commission filings show the position of several larger institutional buyers, such as JPMorgan, Swiss National Bank, and Commerzbank, has moved to adding more silver, creating upward pressure on prices.

Other long-term factors are now coming into play affecting silver supply and demand and leading experts to ask if we’ve reached peak silver. With mine production at the lowest level in a decade and global silver scrap supply at the lowest point since 1996, silver supplies dropped more than 32 million ounces in 2016. 1 Of course, this decrease in supply also comes in the face of a significant surge in demand in the solar energy market, up 43 percent in 2016.

Several key economic reports are due out this week, including the first jobless claims of the quarter. This data will provide more sense of the direction of the U.S. economy, and will therefore play a role in how traders continue to view this current upward price movement. A primary reason these numbers are important over the next 30 days is the role they will play in determining if the Fed moves ahead with its anticipated December rate hike.