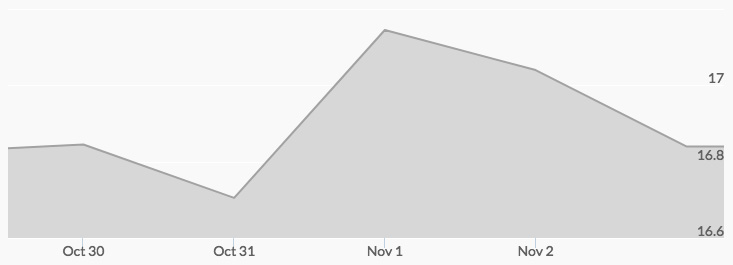

Silver prices followed a similar pattern to gold this week but with less overall movement and also finished the week comfortably higher. The historic silver price chart indicated that Monday opened at $16.75, saw slight movements in intraday trading and ended the day up $0.10 at $16.85. Afterhours trading put pressure on silver, and Tuesday opened at $16.78, but the bulls narrowly won the day to drive the price back up to $16.77. Wednesday’s open was up significantly at $16.93, and the upward momentum continued to drive the price of silver all the way up to $17.14. Silver prices opened on Thursday down slightly at $17.13, and silver slipped a bit to close at $17.11. While Friday’s open was up at $17.15, the day ended at a more modest $16.91, still up by $0.16 for the week.

Like gold, silver was affected mainly by the news Thursday of both Jerome Powell’s nomination for Fed chair and the release of the House Republican tax plan. However, shortfalls in silver supply is putting increasing amounts of pressure on the most industrial member of the precious metals complex and driving prices higher.

Given increasing concerns that the equities markets and strong dollar are inflated by artificially low interest rates and long-time economic policies from both parties that prioritize growth over all other concerns, the case for a medium- to long-term massive bull run in the precious metals complex, silver in particular, is growing. 1 2