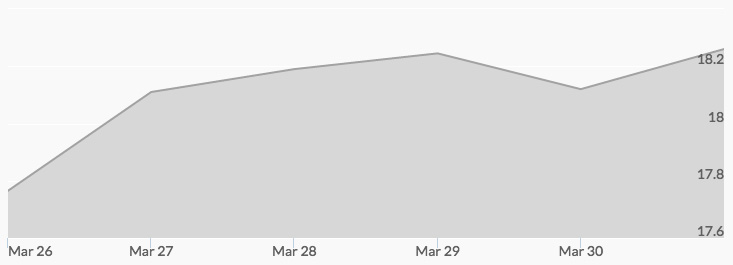

Silver attracted steady buying throughout the week, which was marked by successive highs for the precious metal. The spot silver price chart showed silver six cents above the $18 mark early Monday, and a daily high of $18.11 was notched in by midafternoon. Tuesday’s trading easily came back from after-hours profit taking to set another high of $18.20. Wednesday followed the same trend as midafternoon silver spot prices hit what would be another high for the week of $18.25. Despite more selling and consolidation, Friday opened with steady buying that closed the week up at $18.27.

Prices for silver proved stronger than that of gold in the late-week trading, and this in spite of absorbing a rise in the U.S. dollar from a three-month low and better-than-expected economic news.

Upcoming speeches by various officers of the Federal Reserve raised slight concern, and some attributed lighter trading to a wait-and-see stance in the markets. While silver lost some of the shine from its March 2 price of $18.43, this week’s movement showed real strength. That trend should continue if the Fed indicates more patience on any immediate interest rate increases, and the government has success in holding back the U.S. dollar.

Earlier market insights into the gap between silver supply and demand are playing out thus far in 2017. The white metal has performed significantly better (nearly 13 percent) than gold (5.77 percent) and even a hot S&P 500 (8.5 percent). This makes the progress since the start of fiscal 2016 even more impressive at 31 percent. 1

Little new economic or political news other than the Fed speeches is expected this week. As the market interprets and reacts to the latest economic news reported on Friday, traders will be watching the volumes and activities in futures in the coming week to gauge the strength in this current bullish silver trend.