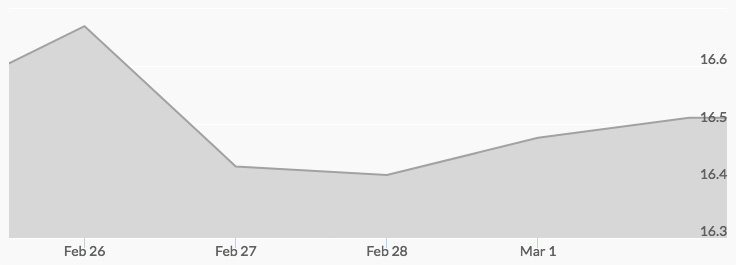

The white metal surged early on last week, pulled back, and then rebounded to end the week only a penny off from the prior week’s close, indicated the historic silver price chart. Silver prices skyrocketed in pre-market trading to a high of $16.73 before opening Monday morning at $16.60, and then rallied still further to end the day at $16.64. Tuesday’s open saw the price of silver pull back to $16.38, but it pushed up to $16.43 by the close. Wednesday opened up at $16.45 before slipping to close at $16.40. Thursday’s open pulled back to $16.25 then blasted up to $16.49 to end the day. On Friday, the price of silver slipped to $16.44 but immediately got back on the bull to close out the week at $16.52.

Remember Bitcoin? Well, the week opened to more murky and salacious news surrounding the cryptocurrency of choice for criminals. 1 Craig Wright, the self-proclaimed inventor of Bitcoin, has been accused of swindling his now-deceased business partner of more than $5 billion in Bitcoin. 2 Bitcoin was first described in a 2008 paper published under the pseudonym Satoshi Nakamoto, and in 2016, Mr. Wright made headlines when he claimed to be the person behind the pseudonym. He is now accused of forging his partner’s signature on contracts transferring assets from his former partner’s estate to himself. Whether he is the real inventor of Bitcoin or not, the case is yet another Bitcoin scandal and reason to stay away as an investor.

Midweek, former Treasury Secretary Larry Summers issued a warning on the likely depth of the next recession. In remarks made to the Global Financial Markets Forum in Abu Dhabi, Mr. Summers made the point that ‘in the next few years a recession will come and in a sense we will already have shot the monetary and fiscal cannons,’ which will make the next recession longer. 3 After years of loose monetary policy and now a major tax cut, the government will have little ammunition with which to battle a new recession.

As the week ended, a bond market story caught our attention. Marty Fridson, a 30-year-veteran of some of Wall Street’s biggest bond houses, concluded that junk bond prices over the past 30 years have defied a normal probability distribution, or bell curve. While he did not draw conclusions from this fact, if this revelation turns out to be evidence of impropriety or misaligned risk/return in high-yield markets, the economy will suffer greatly.