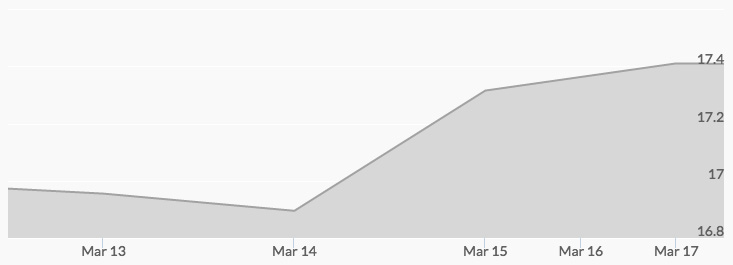

Last week’s silver spot price chart shows when the Fed announced its plans for another interest rate hike. The price of silver opened at an even $17 on Monday. The combination of market anticipation of the FOMC announcement and of the results of the Dutch election placed downward pressure on silver prices, and by Wednesday they had pulled back to $16.86. Once the results of both events hit the news headlines, the markets responded with heavy buying, quickly sending the price of silver to $17.35. Steady buying kept the price in a narrow range on Friday, with the quote closing up $.40 on the week at $17.40.

The reaction to the Fed’s quarter-point interest rate rise shows that the market had expected and fully priced in the increase. 1 Some observers, used to almost knee-jerk reactions to Fed increases, took stock of what the increase actually means. That significance is, with the Fed homing in on its 2 percent inflation target, the .75 percent to 1 percent Fed rate means savers are still losing a full point on their deposits.

While increasing interest rates normally draws attention and buying away from precious metals, this decade of historically low rates has cost those holding paper assets trillions of dollars in returns. On the other hand, the appreciation in the price of silver and gold has generated significant long-term returns for the holders of these precious metals.

The Dutch election results showed that the move to a populist environment in Europe is perhaps slowing, and this provided some sense of security to the markets. However, the U.S. dollar’s weak showing during the week also helped create more buying in silver and precious metals. 2