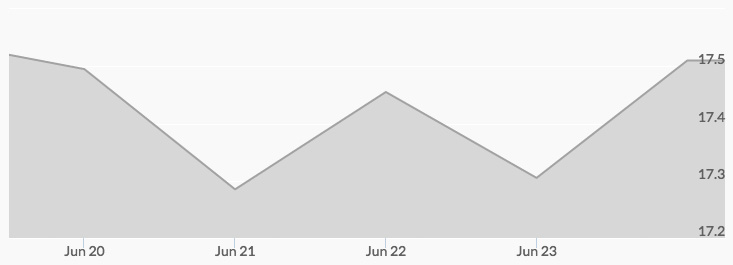

Silver’s focal point this week was the Brexit vote. Monday had silver opening the week around $17.45 per ounce, up 0.2% from last week’s six-week high. Gold was the weaker of the two metals this week, but both enjoyed drastic skyrocketing on Thursday when Great Britain voted to leave the European Union.

The referendum vote surprised many, as most anticipated the country to choose to remain in the EU. Leaving the security of the EU could tumble Britain into another recession. This volatility in one of the major industrialized economies caused gold and silver to surge on Thursday as safe haven stores of value. Unraveling the social and economic ties from Britain to the European continent could be extremely disruptive.

Friday morning saw the euro and the dollar sinking as precious metals rose. The British pound sank to a three-year low. The price of silver reached nearly $18 per ounce Friday morning.

Two additional factors to consider about silver this week are the role of silver in solar technology, which will support demand, and global economic fears, which funnel people back into precious metals, as we have seen this week.