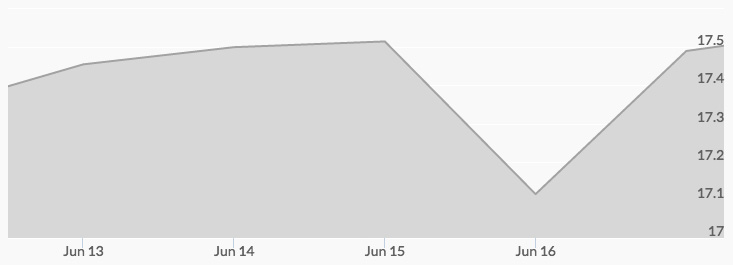

The price of silver followed the trajectory of gold precisely this week, gaining strength on Wednesday and peaking on Thursday after the Federal Reserve announced its decision not to raise interest rates right now. Precious metals become a stronger safe haven investment when financial markets are turbulent. Silver reached $17.80 per ounce Thursday, then after sell-off pressure from profit-taking closed Friday around $17.40.

While silver’s path this week largely correlated with gold and was influenced by the same economic conditions that affected gold, namely the Federal Reserve meeting, Brexit discussions, and a falling dollar coupled with lower global markets, another indicator for silver is worth discussing. The gold to silver ratio appears to be artificially high at the moment, at around 75:1. This means it takes 75 ounces of silver to equal one ounce of gold. However, only one ounce of gold is being newly produced compared to nine ounces of silver, indicating that the ratio is set to rise, causing silver to become more valuable.

The silver market has also been subject to extreme price manipulation by big banks, and this also contributes to a relatively lower silver price, considering external and market factors. Meanwhile, Pan American Silver has been a top performing stock this year, gaining 133% year-to-date, higher than both the silver miners index and the gold miners index.