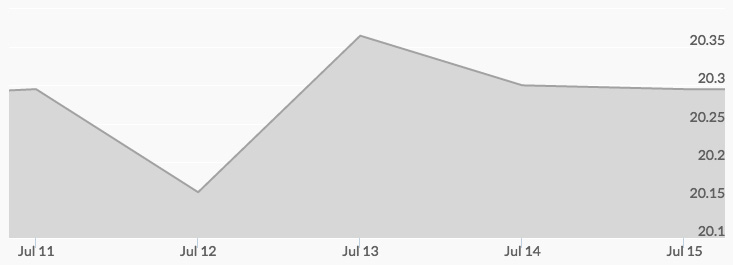

Silver continued its upward trend this week, rising 2% on Monday from last week’s close to touch $20.67 per ounce, yet still below last week’s two-year highs. While gold struggled this week against a basket of somewhat positive economic indicators, silver remained relatively steady.

Silver’s myriad uses in industry means that the silver demand is different from the gold demand. Silver received support from copper prices early Tuesday, lifting while gold fell. While silver also responds to economic troubles, the white metal is less resistant currently to lessened safe haven demand. The silver price did drop Tuesday afternoon, but showed strong resilience by Wednesday as new players may have entered the market.

The price of silver has gained 50% so far this year, reversing three years of losses. In the last ten years, silver’s movements have been largely erratic, swinging from $7 to $50 per ounce.

Silver also responded negatively to the Bank of England’s surprising move not to institute new easy monetary policy mid-week, slipping slightly through the end of the week to land around $20.15 per ounce.