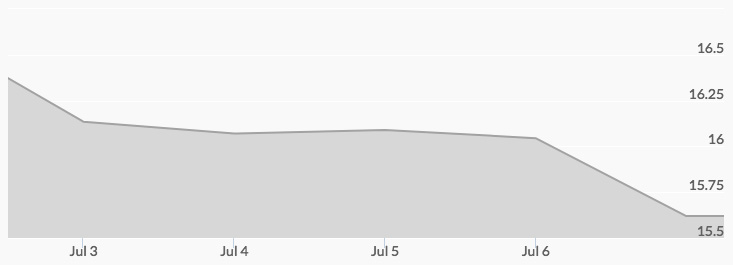

The price of silver chart indicates the white metal started the week at $16.30 on Monday, and stayed in a narrow range before closing at $16.16. The first quote on Tuesday was $16.07 and the close was $16.13, with little movement while the U.S. markets were closed for the Fourth of July. Silver prices on Wednesday opened below the $16 market at $15.95 and saw positive movement to close up at $16.09. The Thursday open was slightly lower at $16.02, but light buying moved the closing quote to $16.08. However, selling in afterhours trading took the price down more than a quarter to a Friday open of $15.76. That trend carried the offer to a low of $12.43 by midmorning before bargain hunting brought the week’s final bid to $15.61.

Much of the market news is focused on the mysterious “flash crash” last Thursday. For unknown reasons the quote for September delivery silver futures contracts dropped more than 11 percent in moments. The move from $16.14 to $14.34 was temporary, with Friday quotes back to nearly $16.00. Traders note this is another in a series of flash crashes that have occurred in the past year with silver and other commodities, and many blame the problem on computer trading models. 1

With ongoing media attention on short-term issues, many analysts believe the longer-term factors of economic turmoil and silver supply deficits will push the price back to a positive for the year. That being the case, the current price levels can be seen as an excellent buying opportunity.

Chinese trade data will be released on Thursday, and this report will be scrutinized for insights into the direction of that nation’s economy. One major indicator of the health of the U.S. economy will be found in the Friday announcement of U.S. consumer prices, the CPI report. The analysis will focus on the expected inflation rates, as this will bear on Fed policies and potential increases in the interest rate later this year. The June minutes of the FOMC meeting suggest this is a major point of concern for the committee. U.S. retail sales data will also be reported at the same time.