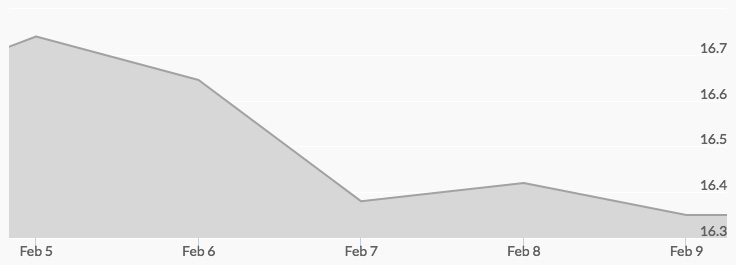

Silver trading opened on Monday up dramatically at $16.83 and closed the day at $16.77 before silver prices shot to $16.92 in afterhours markets, reported the historical price of silver chart. Tuesday opened slightly off at $16.72 then pulled back to $16.60 by the close of trading. Yet the price of silver rallied in afterhours trading again, this time to $16.76, before opening on Wednesday slightly up on Tuesday’s close at $16.62. Wednesday marked the beginning of the pullback for the week, however, and the day’s trading closed down at $16.34. Thursday’s open slipped to $16.32, then the white metal traded in a tight range before closing up at $16.39. Friday’s open slipped ever so slightly to $16.36, dipped to $16.21 by noon in New York, and then rallied to close the day slightly up at $16.37.

The week opened to more bad news for cryptocurrencies. On Tuesday, Bitcoin’s value sank below $6,000 for the first time since November 2017 after having hit a peak of $19,991.60 in December. 1 Sliding steadily over the past month, this most recent Bitcoin crash was doubtless precipitated by actions taken by several U.S. and U.K. banks to ban the use of credit cards for purchasing Bitcoin. 2 The same day noted economist Nouriel Roubini predicted that Bitcoin will crash to zero, while on Wednesday, Jim Yong Kim, World Bank Group President, compared cryptocurrencies to Ponzi schemes. 3 4 One thing is for certain: the voices that once called for Bitcoin to replace precious metals as the primary alternative investment and safe haven have gone very, very quiet.

As the week ended, some developments in the currency markets caught the eyes of certain investors. After bottoming out against most currencies to start February, the dollar rebounded somewhat in the past couple of weeks. However, strategists predict the rebound is unsustainable. 5 6 The sentiment in the options markets also suggests that many savvy investors expect dollar weakness to continue into 2018. The cost of hedging dollar weakness versus both the yen and the euro is higher than the cost of hedging that the dollar will gain, a clear sign that the market is pricing in more dollar dips. 7 There’s nothing like the price of risk to provide unambiguous guidance on how people really feel. Expect more dollar weakness in 2018.