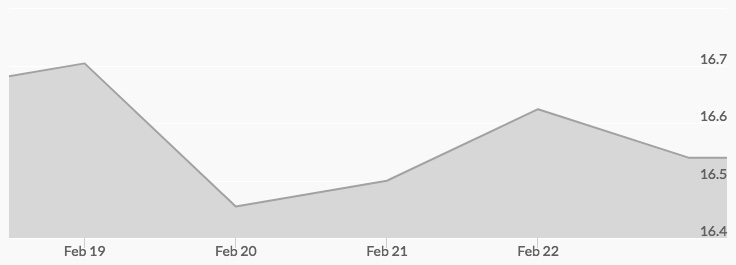

After the President’s Day market holiday on Monday, live silver prices slipped to $16.54 on Tuesday morning, rallied to $16.63 in the first couple of hours of trading, and then pulled back to $16.48 by the close. Wednesday morning’s open saw the price of silver slip to $16.44, but the white metal then shot up to $16.66 by noon in New York trading, before ending the day at $16.49. Thursday opened with silver prices off by a penny at $16.48, then the markets had another big rally to close out at $16.61. Friday opened flat on Thursday’s close and then slipped to $16.53 to end the week, off only a penny from Tuesday’s open.

The week opened to a gloomy report from Morgan Stanley on the likelihood of further trouble in the stock market. The bank’s economic strategists indicated that the recent volatility in equities was an ‘Appetizer, not the main course,’ and that when growth slows while inflation rises, equity returns are worst hit. 1 Given recent news on inflation and the growing likelihood of a recession in the near future, another stock market correction is likely. 2

Midweek, Federal Reserve Governor Randall Quarles appeared to be much more bullish on the U.S. economy. In prepared remarks at the Institute for International Monetary Affairs in Tokyo, Mr. Quarles claimed that planned interest rate hikes would easily control inflation and that the tax break would fuel investment. 3 However, it’s hard to see how an economy can expand forever regardless of a country’s economic policies.

It didn’t take long for more negative news on the economy to hit. The week ended with some startling news that regulators are investigating market manipulation in the VIX, or the equity markets volatility index that recently caused investors to lose billions. 4 In a letter addressed to both the Securities and Exchange Commission (SEC) and the Commodities Futures Trading Commission (CFTC), lawyers for a whistleblower close to the alleged market manipulation outlined how false market orders have been used to cause artificial price swings in the VIX. 5 Given that the index is widely used to hedge market loses and is heavily traded itself, a loss in confidence in one of the market’s most important indicators is eerily reminiscent of earlier crises 6.