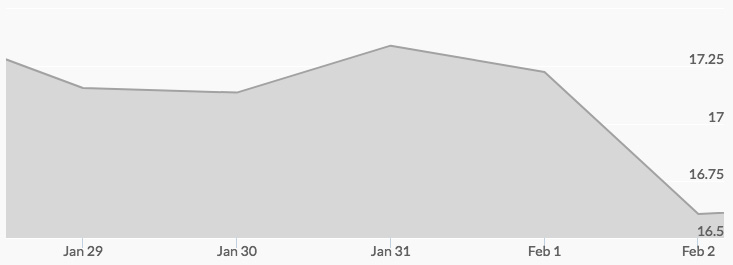

After a massive rally the previous Friday, live silver prices pulled back to open Monday at a more modest but still respectable $17.21, then traded in a range before ending the day at $17.19. Tuesday’s open saw the price of silver surge to $17.24 before it slipped to $17.12 by the close of trading. Silver really got going in afterhours trading, however, and Wednesday’s open shot to $17.28 before continuing the rally to $17.34. The metal rose to a high for the week of $17.37 in afterhours trading but cooled to $17.23 by Thursday’s open. After dipping in intraday trading, the market again rallied to $17.25 to end the day. Friday’s open slipped to $17.15 and then the market pulled back to $16.59 to end the week.

Monday’s trading opened to the news that the head of Deutsche Asset Management’s Chief Investment Office, Markus Muller, issued a warning to their clients that Bitcoin investors faced a ‘realistic risk of total loss.’ The office serves as the $880 billion asset management arm of Deutsche Bank. Muller stated that Bitcoin was not a recommended investment for the firm’s clients and said pointedly, ‘It’s only for investors who invest speculatively.’ 1 Bitcoin ended the day on Friday at $8,287.12, which marked a fall of $8,848.72 or a whopping 52 percent since January 6. 2

Precious metals investors were buoyed midweek by the announcement that Pacific Investment Management Co. (PIMCO) had made the call that the U.S. was now embroiled in a ‘cold currency war.’ PIMCO global economic adviser Joachim Fels posted the analysis on his PIMCO blog, where he argued that the U.S. is not only engaged in the cold currency war but is winning it by maintaining a weak dollar. 3 Mr. Fels predicts the dollar will stay weak for some time, portending great things for precious metals investors. PIMCO is one of the world’s largest investment managers, with $1.75 trillion in assets under management as of December 31, 2017. 4

The week ended on news that the first job report of 2018 showed not only continued growth in job creation but a robust increase in wages. The U.S. Bureau of Labor Statistics report showed that the economy added 200,000 jobs in January, ahead of expectations, and wages rose by 2.9 percent, the fastest rate in eight years. 5