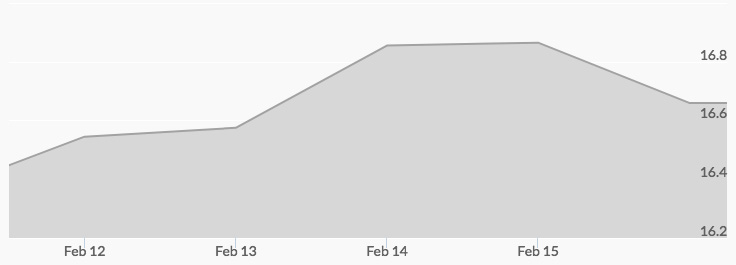

Silver got back on track last week! Live silver prices opened at $16.54 on Monday, up $0.17 on the previous Friday’s close, and never looked back. Monday closed with the price of silver moderately up at $16.56. Silver prices surged to $16.62 on Tuesday morning and drove to $16.67 by the end of the trading day. Wednesday’s open dipped to $16.62 but rallied to a whopping $16.88 by the close, then shot to $16.97 in afterhours trading. While silver prices cooled slightly to open Thursday at $16.85, the market then rallied to $16.89 by the end of the day. Friday opened slightly off at $16.82 and slipped to $16.65 by the close—yet silver still enjoyed a 1.7 percent spike in value over the previous week.

The week’s news got off to a rocky start for markets as billionaire investor Ray Dalio, co-chairman of the successful hedge fund Bridgewater Associates, wrote that “the risks of a recession in the next 18-24 months are rising.” In short, Mr. Dalio argued that while the current growth in corporate profits, when combined with the excess in uninvested cash, will cause a temporary spike in equity prices, the economic cycle is rapidly nearing its end and will take equities down with it. 1

Midweek market news was dominated by the latest inflation numbers reported by the federal government, which came in higher than expected. The news caused the 10-year Treasury yield to spike over 2.90 percent on suspicions that higher inflation would lead to bigger than anticipated interest rate hikes. 2 Analysis of the details of the inflation report also showed that apparel prices rose at the highest rate in the past 30 years, which does not bode well for the future of the economy. 3 On Thursday, the 10-year reached an intraday high of 2.944 percent, a level not seen since January 2014. 4 Market wisdom has it that once the 3.0 percent level is breached, funding for a wide variety of investments are hurt and equities will tumble, so this latest spike in yields is anything but bullish for equities or the economy. Now is the time to invest in safe haven assets like gold and silver!