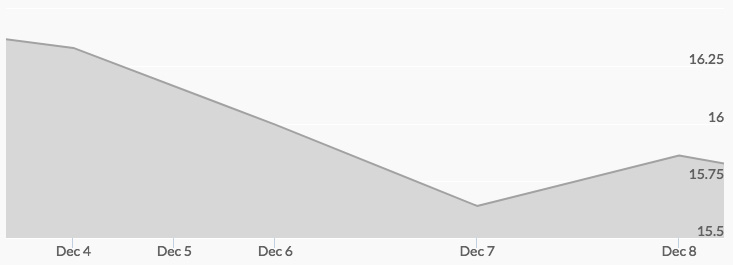

Silver prices opened in the midst of a pullback this week at $16.34, but recovered slightly to end the day on Monday up at $16.35. Tuesday saw live silver prices open at $16.27 and slipped a bit in early trading then leveled off to end the day at $16.13. Wednesday opened with the price of silver down slightly at $16.08 and saw a pullback during the day to $15.99. Thursday started the day at $15.83 and retrenched to close at $15.74. The end of the trading week saw the precious complex recover, however, as Friday opened up substantially at $15.82 and silver kept rising throughout the day to close the week out at $15.86.

Monday’s trading was dominated by a reaction to the tax plan passed by the Senate late the previous week. 1 While the short-term reaction was a run up in the dollar and equities, a closer look at the analysis of the tax proposal shows that a substantial portion of the commodities complex stands to gain in the medium to long term, a bullish sentiment for precious metals. 2 Adding to the longer-term bullish outlook for precious metals was the news that China is likely to overtake the United States as the world’s largest importer within the next five years.

The week ended on a positive note for precious metals as President Trump’s announcement that his administration would recognize Jerusalem as the capital of Israel and relocate the U.S. embassy there sent jitters throughout the markets. The move is in line with much of the campaign rhetoric used by presidential candidates from both parties going back decades but controverts actual policies once elected, as each president has held back in hopes of advancing the Palestinian/Israeli peace talks. 3 The announcement sparked a wave of protests throughout Muslim countries and wide condemnation from Muslim leaders, and caused a flight to quality in financial markets.