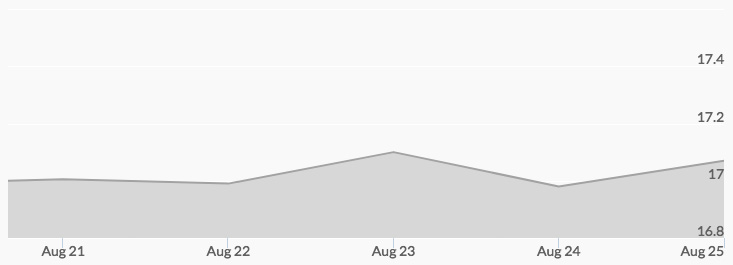

Monday’s opening bid of $17.11 was the first sign that it would be a strong week for silver. The day closed with silver prices at $17.01 due to light profit taking. Tuesday morning saw live silver prices of $17.02 before trading took the close to $16.98. Silver prices gained a cent by Wednesday morning, opening at $16.99. More buying took the price back above $17 by midmorning and resulted in a daily close of $17.08. Aftermarket activity sent the price of silver to $16.98 by the opening bell on Thursday and light trading shaved another nickel off to close at $16.93. The price of silver opened at $16.87 on Friday, but the close moved back to the $17 range at $17.04.

Silver, gold, and other precious metals have recently enjoyed a surge in popularity due to political and economic issues. Concerns over nuclear threats from North Korea continue to send investors to save haven assets. The first readings of the FOMC minutes and the speeches given Friday at the Jackson Hole Economic Policy Symposium were that there is still some hesitancy by the Fed to aggressively pursue its desire to raise interest rates. This may well prove bullish for next week’s trading as the futures market continues to show upward buying pressure. 1

Several U.S. government reports will influence the market this week, with the Friday jobs data being of primary concern. The economic tealeaves continue to be murkier than normal, and any surprises in these reports will affect short-term sentiments.