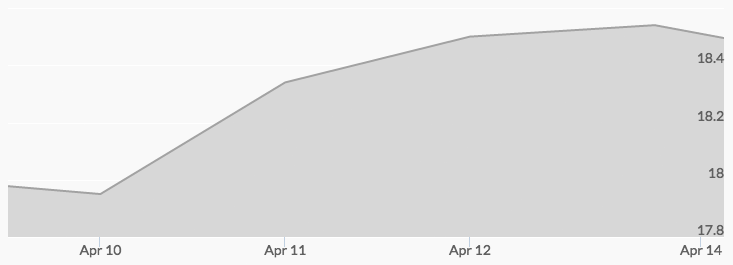

The silver market showed increasing strength with steady buying after digesting last week’s news and trading. The opening price of silver of $17.81 on Monday proved to be the low for the week, with a steady rise to a close just four cents under the psychologically important $18 mark. The momentum continued into after-hours trading, carrying the silver price to $18.11 on Tuesday’s opening. Steady buying took the price to $18.38 by closing with uninterrupted increases, indicated the spot silver chart. Wednesday did see some early profit taking and consolidation before continuing the run-up to close at $18.52. Thursday saw more silver buying that carried into the early close Friday at $18.54, setting a five-month high for the price of silver. This marked one of the strongest one-week gains of recent months.

Indications are that investors seeking safe haven assets and speculators taking long positions fueled strength in the silver market. The increases in gold and silver prices during 2017 have some market observers beginning to whisper the word “breakout,” suggesting the markets are supporting a new, higher floor for both metals. 1 In addition to the hopes of a dollar decline, silver is benefiting from an increase in the number of institutions reallocating significant funds to safe haven investments. 2

Silver prices have already received a boost in recent months from a growing gap between supply and demand in the market. There is an increasing consensus that both gold and silver will do well in 2017, with an opportunity for the white metal to outperform gold due to limited supplies. Some market participants are revisiting the gold silver ratio to evaluate their positions while both metals rise in price.

As long-term buyers of silver welcome the vindication of their positions with increased attention from speculators, they are most pleased with the bullish market factors. While silver continues to react to current news, the major factors are showing price movements based on a number of fundamentals that point to further increases in the value of the white metal.