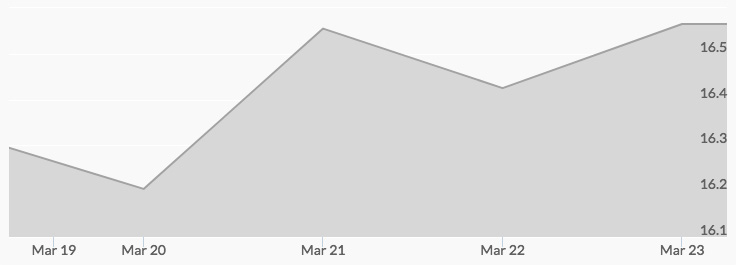

The white metal opened on Monday at $16.32 and didn’t move much throughout the trading day for a close of $16.33, reported the silver price chart. On Tuesday morning, silver prices opened slightly off at $16.27, and then slipped to $16.20 by the close. By Wednesday though, the market had turned: the day opened with the price of silver at $16.25; it then skyrocketed 2.2 percent to close at $16.61. Thursday’s open slipped to $16.52, then pulled back to a still-strong $16.40. On Friday the bulls pushed back, however, and the white metal jumped to open at $16.53, and then pushed up further to close out the week at $16.57.

Last week’s news opened with coverage of yet another government funding deadline. Wrangling between Republican leaders and the president on funding priorities in the $1.3 trillion omnibus spending bill continued throughout the week, with specific focus on the Gateway Hudson rail project and the border wall.[1] After weeks of negotiations, the bill finally passed both houses of Congress on Thursday, and, although he threatened a veto on Friday morning, the president signed a bill into law Friday afternoon that will keep the government funded until September.[2] The near-shutdown yet again added to an already skittish outlook prevailing amongst investors, sending equities and the dollar crashing.

Another news story added support to predictions of a recession. In the beginning of the week, a report by Citigroup highlighted that a technical indicator of stress on the financial system had reached levels not seen since the 2008 crisis.[3] The indicator is the spread between the LIBOR (London Interbank Offer Rate), used for short-term loans between banks, and the OIS (Overnight Indexed Swap) rate, which occurs when the overnight interest rate is exchanged for a fixed interest rate.[4][5] The spread is widely viewed as the difference between a risk-free rate and a rate with a broad measure of credit risk in the financial system built into it. When it widens, the market is seeing more credit risk in the system, and so it now appears that investors see levels of credit risk in the system akin to the 2008 crisis.[6] The flight to quality is taking off, and it’s time to get on board!