Gold proved to be the talk of the town last week thanks to one very big day of performance. In fact, it proved to be the largest day of the year for the precious metal, helping turn a month of losses into a month of gains overnight. It’s not clear whether a big surge indicates a badly-needed bull market, but gold has begun performing again.

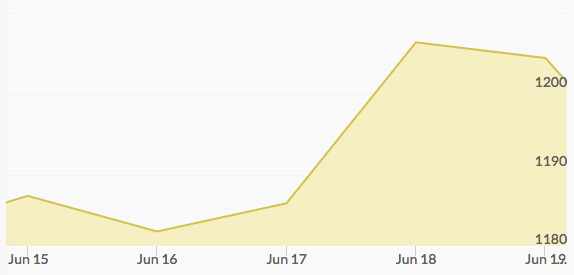

Monday opened up the trading session after a particularly lackluster week prior. Gold didn’t do anything impressive on the day, falling by just under five dollars per ounce to close out at $1,181. By midday, gold had dropped over ten dollars per ounce but a late afternoon surge brought it back up to “only” fall by half that amount on the day.

Tuesday saw gold make up the drop from the prior day and tack on a little bit more value, closing out the trading day at $1,187 per ounce. This rise came mainly on the back of rumors that the next day’s Federal Reserve report would (yet again) indicate the Fed will push back the decision to raise interest rates past the summer and into the autumn.

Wednesday saw almost null movement as gold climbed by less than one dollar. An interview with Gwen Maven of ResourceVault noted that the mining company CEO believed the market to be at a bare bottom for gold and that the commodity could not get much lower. Her view was that gold couldn’t drop below $1,100 because it would disenfranchise mining operations and thus tighten supply.

The biggest day of the week, and in fact the year, came on Thursday, when gold climbed by no less than fifty dollars per ounce to break back above the $1,200 barrier in stunning fashion. The Fed’s announcement on monetary policy (specifically forgoing a rate hike in the current economic climate) sent investors rushing to gold in order to pick up on inflation-proof assets.

Friday saw maintenance rather than any drastic movement. The price of gold dropped slightly to close out just above $1,200 per ounce but the contracts moved were huge—a quarter of a million in total.