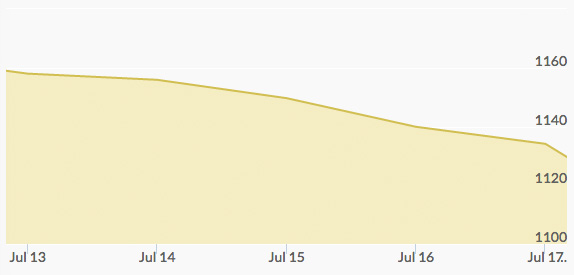

If ever you hoped for good news on the gold market, last week was not the time to find it. Gold has hit the absolute skids in a full-blown bear market, with fewer and fewer investors looking to put their money in precious metals as the dollar rises further. Gold hit a two-year low last week, indicating that there’s a lot of room to go before it swings back upwards.

Monday saw gold open at $1,163 and close at $1,157, a loss of nearly half of one percent on the day but still less than silver pricing, which lost nearly .6% in the same trading day. With the release of Treasury data suggesting revenue came in at about $800 million more than expected, it was a good day for the dollar and a bad day for gold.

Tuesday would be the best day of the week for gold simply because it had no net loss, while silver lost nearly .8% on the day. Although gold didn’t do so well, the price of oil climbed by 1.6%, providing some semblance of hope for a battered commodities market. Gold contracts were very light on Tuesday, with only 120,000 in total.

Wednesday saw gold drop perilously close to $1,150. While the stock markets writ large improved on the news that the Greeks will take a new bailout deal (one that’s worse for them than the previous bailout deal they rejected), gold didn’t get the bump it so badly needed to improve.

Another five-dollar drop characterized Thursday’s trading, where gold fell like a rock early on in the day, stabilized, and ended trading at just over $1,145. This marked the first time in eight months that gold had dropped below the $1,150 figure.

Friday closed out the trading week with the worst performance for the price of gold in the past twenty-four months. Gold absolutely collapsed, with a full one percent loss to close out the week at a hair under $1,130. The Grexit remained the topic du jour, with investors uncertain about the German bailout plan’s capability to raise the Euro, and the EU’s recession, out from under water. Accendo Markets wrote to clients noting that the “talks of interest rate hikes” contributed to the ongoing three-month slide for the precious metal.

When I buy gold is it reported to the IRS regardless of the amount I purchase?

When I sell my gold do I have to report the sale and pay tax on it?

To whom do I sell my gold and how much in fees or commissions do I have to pay?

Thanks. Ken