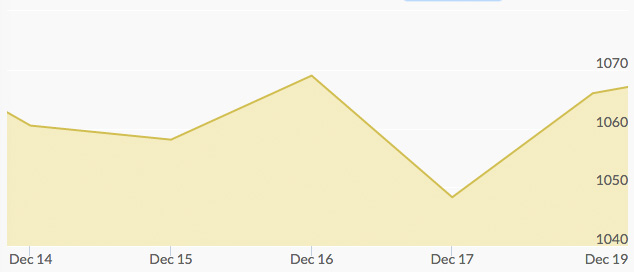

The downward trend that has characterized the last two months of gold trading came to a head this week as the FOMC convened for its last meeting of the year. Monday opened the week with gold prices 1% lower than Friday, around $1,060. Dollar strength and oil weakness contribute to the continued losses, but the prices have been kept down primarily because of the expected interest rate hike.

Tuesday’s gold prices stayed within a set range ahead of the two-day FOMC meeting that occurred Wednesday and Thursday. Wednesday’s prices were actually robust as gold gained on the early news of the FOMC meeting. Investors have been anticipating for a while that interest rates would increase from 0.00% to 0.25%, and indeed the news arrived as expected. This was the first time the Federal Reserve has raised interest rates in seven years, and they are doing so based on the assumption that the economy is positively recovering. Traders were also watching for clues from Janet Yellen about how often and how soon additional rate increases might occur.

By Thursday, as expected, once the rate hike became crystal clear, the price of gold dropped. Gold sank 2% to hit a six-year low as the dollar received some lift. Friday, however, saw an unexpected rise in gold prices by 1.2%, hitting $1,060 again. The European stock market saw some turbulence, contributing to gold’s buoyancy. The Japanese Yen also bounced against the dollar at the end of the week. Now that the interest rate hike is officially in place, gold news may broaden its scope to consider other global economic factors. Buying gold gives investors a sense of security because it is a store of value across the world and always holds intrinsic value, even against temporarily bearish factors such as a U.S. interest rate hike.