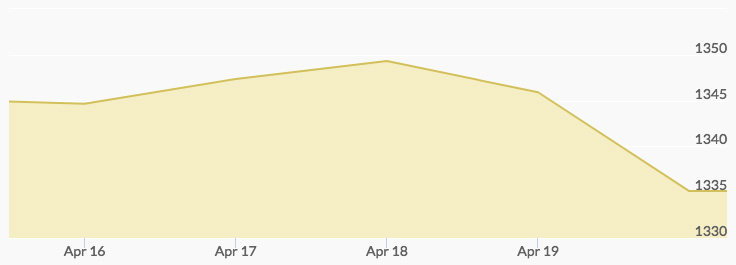

Monday saw gold prices open at $1,347.20 before rising to $1,348.90 around midday. The first trading day of the week closed at $1,345.60. On Tuesday, the price of gold experienced a slight dip to $1,344.30 at opening, pulling back further later in the day to $1,338.00 before recovering and finishing at $1,343.70. On Wednesday, gold prices opened at $1,344.10. The yellow metal closed the day at $1,350.90, reported the gold price chart. Thursday, gold opened at $1,351.70 before reaching its week peak price of $1,353.10 around 3:00 pm ET. It closed the day at $1,342.10. Friday saw gold opening at $1,342.60. The day’s end offered a great buying opportunity with gold prices at $1,334.70 before they closed at $1,335.20.

Analysts linked Monday’s increase in gold prices to a weak dollar.[1] However, the day also brought the news that Kalamazoo Resources planned to buy three gold projects in Pilbara, Western Australia.[2] This could increase gold inventories. On Tuesday, analysts said that gold prices were continuing to gain throughout the day based on lingering worries over U.S. sanctions against Russia.[3]

Prices broke the resistance level of $1,350 late in the week due to increasing safe haven demand. Thursday saw gold production resume at a pair or Randgold mines in Mali. Production had been halted due to an overnight strike Wednesday to Thursday.[4] Analysts with Reuters predict that the metal may reach $1,370 or higher as demand increases throughout the year. If they are correct, this means that now is the time to buy gold before prices jump again!