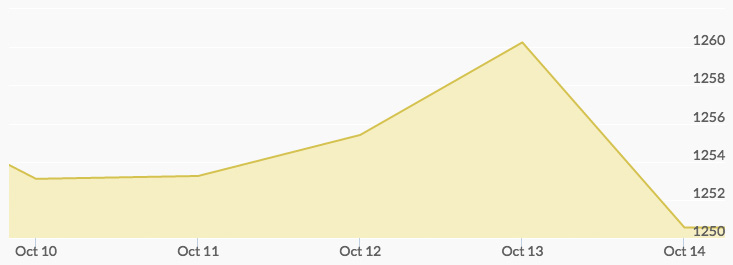

Monday opened the week with a renewed sense of technical buying after last week’s dramatic losses, opening higher than $1,250 per ounce. The price of gold dropped 5% last week, the steepest weekly decline in 3 years after Fed signals indicated a rate hike before the end of the year. Traders put the likelihood of a rate increase at 68%, the highest in four months. Crude oil prices hit a four-month high after Russian President Vladimir Putin revealed he is willing to cooperate with Saudi Arabia to manage global oil supply.

Gold prices fell on Tuesday after Chicago Fed President Charles Evans said the economy is on solid footing for a December rate hike. Oil prices also fell on profit taking.

The Fed’s meeting on Wednesday concluded with no current rise in rates, but continued indication of the possibility in December. Gold prices rose after weak data on Chinese exports, which is a sign of faltering global demand. Gold stayed in the $1,250-$1,260 per ounce mark all week, with no significant outward pressure lower at this time.

By Friday, the dollar was rising, and gold closed near $1,250 per ounce. Next week’s retail sales data could shine more light on the domestic economic situation; the upcoming U.S. presidential election is also in the background of traders’ minds.