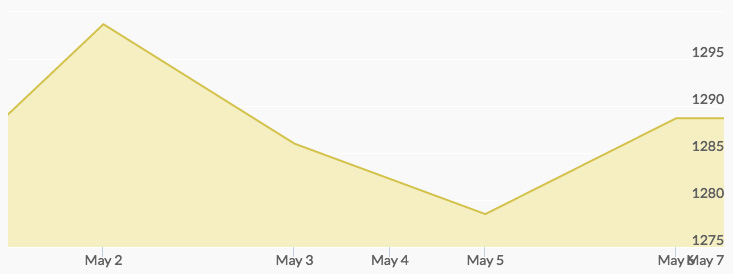

Gold reached a peak of $1,300 per ounce in trading on Monday, hitting that key price point for the first time in 15 months. The main driver was a flailing dollar, which was very weak against other national currencies, including the Japanese yen. The momentum didn’t hold, however, partially perhaps because Asian and London markets were closed for national holidays.

Gold rallied to a high of $1,303 but didn’t push through to $1,306, which was January 2015’s high. Tuesday’s gold price hovered beneath that high point, maintained by a weak dollar, safe haven demand and risk-off sentiment.

By Wednesday, gold had lost gains due to profit-taking and a higher dollar combined with lower oil prices. An employment report showcasing weak job growth was issued Wednesday, which boosted gold temporarily. Thursday’s gold market reflected much of the same, trading in a narrow range as the dollar rebounded.

The big gain of the week occurred on Friday when more U.S. jobs reports showed that the jobless rate, which was expected to ease, remained steady at 5%. Gold shot up from $1,275 per ounce to $1,295 per ounce, largely on revised estimates of when the Fed’s next policy change would take place based on this employment data. A June rate hike now appears unlikely.